Automakers persist in their efforts to find the right balance between EV, hybrid and ICE vehicle production. The mythology suggests that EVs have stagnated, but that’s simply not true. They have slowed from their unsustainable pace, but they continue to rise. The increases come, in part, because the newest electric vehicles come in the buyers favorite form: SUVs.

So many companies have adjusted their EV production schedules to slow down to meet the actual demand for battery electrics. Now we see with more a more reasonable pace, consumers continue to buy EVs in growing numbers.

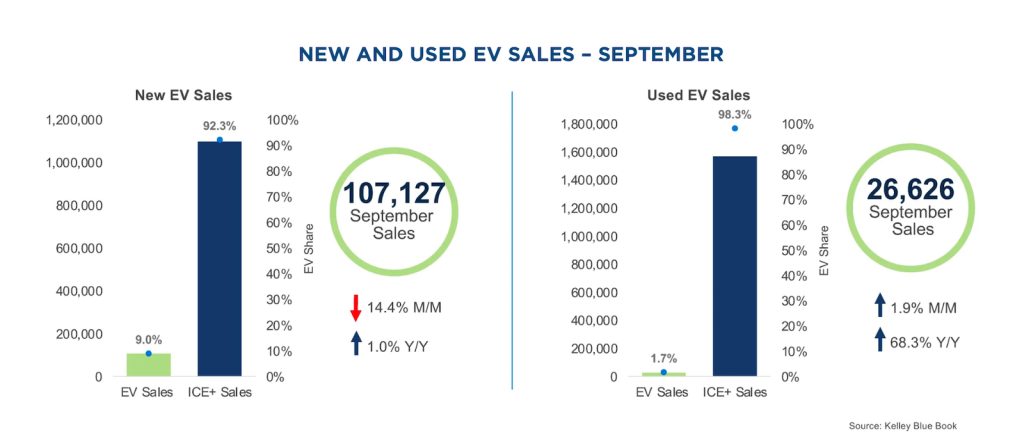

According to Cox Automotive, sales for new and used EVs rose year-over-year in September. It also marked the sixth straight month where new electric vehicle sales surpassed 100,000 units. This bumped their market share up to 9%. It was less than 8% at the start of the year and is expected to hit 10% before the end of 2024.

Meanwhile, used EV sales demonstrated steady growth, reaching 26,626 units sold and maintaining a 1.7% market share. Used EVs remain a small part of the market and have not exceeded 1.8% of total used-vehicle sales.

Give them what they want

There are plenty of reasons for the rising popularity of electric vehicle and electrified vehicles overall. Improved fuel economy, instant torque and home charging are just a few.

There are plenty of reasons for the rising popularity of electric vehicle and electrified vehicles overall. Improved fuel economy, instant torque and home charging are just a few.

Give the automakers some credit here too. They know what Americans like and are working to make sure they’re giving it to them in increasing numbers: sport-utility vehicles. The first round of mainstream EVs were cars, such as the Nissan Leaf and Tesla Model 3.

But now, the current wave features a very familiar form, including the Tesla Model 3, Ford Mustang Mach-E, Hyundai Ioniq 5 and Chevrolet Equinox to name a few.

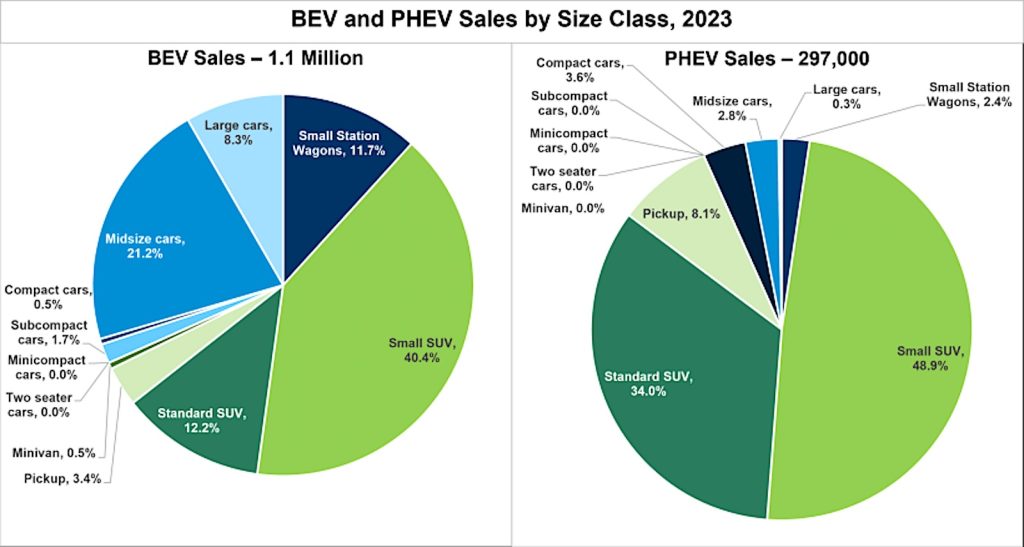

In 2023, SUVs made up over half of all battery electric vehicle and plug-in hybrid electric vehicle (PHEV) sales, according to the U.S. Department of Energy. Americans bought about 1.1 million EVs last year and 52.6% were SUVs. The number jumps to 82.9% when you look at plug-in hybrids. Cars represented less than 10% of all PHEV sales but accounted for 43.4% of BEV sales.

More EV Stories

- EV Sales Set Global Record in September

- Ford Revises EV Plans, Dumps 3-Row SUV, Delays Next-Gen Pickup

- These are the Best EVs You Can Buy Today — Says Consumer Reports

And they’ll buy them

According to Kelley Blue Book, U.S. electric vehicle grew by 11% year over year during the third quarter, hitting record highs for both volume and market share in the process. KBB.com estimates 346,309 EVs were sold in Q3 2024, a 5% increase from Q2. The EV share of sales in Q3 hit 8.9%, the highest level recorded and an increase from 7.8% in Q3 2023.

“The growth is being fueled in part by Incentives and discounts; but as more affordable EVs enter the market and infrastructure improves, we can expect even greater adoption in the coming years,” said Stephanie Valdez Streaty, director of Industry Insights at Cox Automotive.

Potential EV buyers found the perfect combination of factors to nudge them into actual EV buyers: higher incentives helping to lower prices. In fact, incentives comprised 12% of the average transaction price during the third quarter. This is a dramatic increase from what buyers find for gas- and diesel-powered vehicles at 7%.

Big spenders and the more frugal

However, big money or economical, there appears to be a market for EVs — at least during the third quarter. Kelley Blue Book, a Cox-owned website, estim ated Tesla sold 16,000 Cybertrucks — with its $116,000 average price — in the third quarter. On the less expensive end, General Motors sold almost 10,000 Chevrolet Equinox EVs in Q3 2024 and produced over 40,000 in the opening eight months of the year

ated Tesla sold 16,000 Cybertrucks — with its $116,000 average price — in the third quarter. On the less expensive end, General Motors sold almost 10,000 Chevrolet Equinox EVs in Q3 2024 and produced over 40,000 in the opening eight months of the year

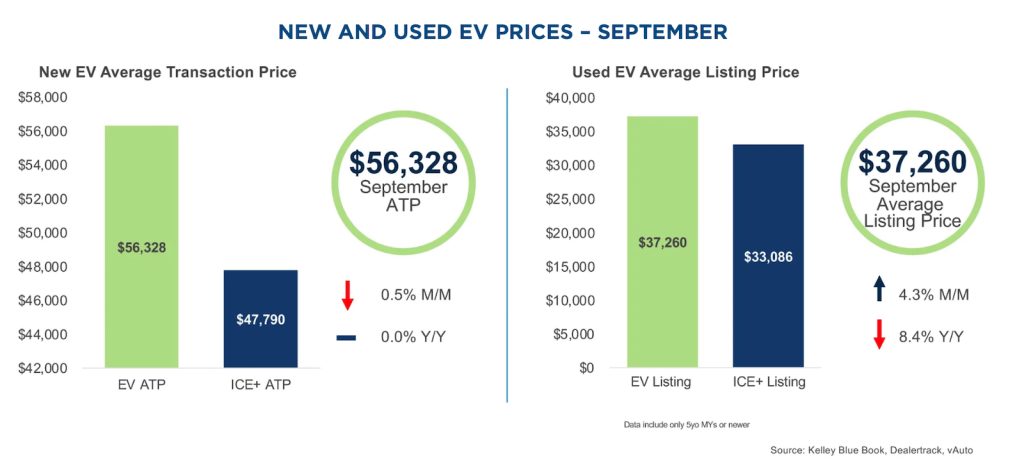

In September, the average transaction price (ATP) for new EVs came in at $56,328, a decreases 0.5% month. It remained flat year over year. The average incentive package for a new EV was over 12%, far higher than the industry average of approximately 7%.

The average listing price of used EVs slightly increased month over month in September to $37,260, yet it remains down 8.4% compared to the previous year, nearing price parity with ICE+ models.

0 Comments