Who says the EV market is on the wane? Not U.S. consumers who bought a record number of all-electric cars, trucks and crossovers last month, according to the latest data. In January, battery-electric models accounted for 9.1% of the market, up nearly nine-fold over the last half-decade, despite the anti-EV push by the new Trump administration. Headlight.News has more.

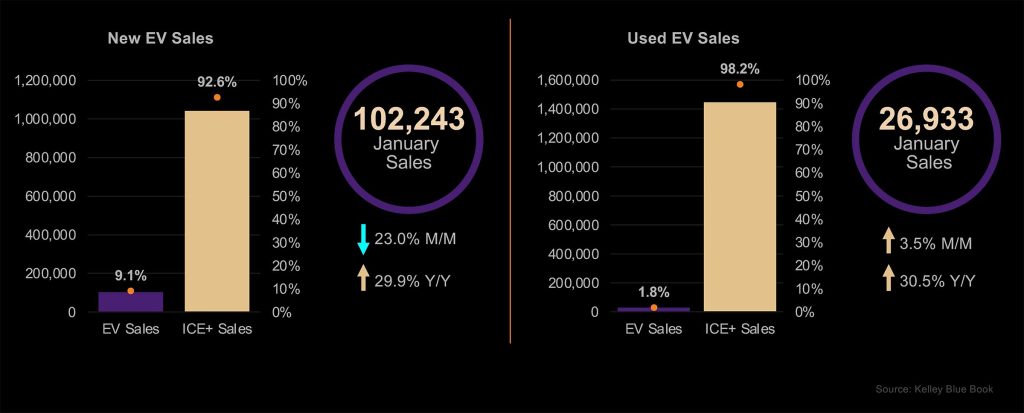

EV sales set a new record in January, surging 30% year-over-year to reach a record 9.1% of the U.S. new vehicle market.

Don’t be surprised to see conflicting headlines. Demand totaled 102,243 last month, according to Cox Automotive, which was a 23% dip from December. But that doesn’t account for normal seasonal trends. January routinely sees new vehicle sales – EVs, in particular – drop a bit as consumers come off post-holiday spending binges. But January was still a notable month for the EV market, the year-over-year increase more than triple the jump in demand for all of 2024, Cox reported.

“While new EV sales saw a decline in volume, market share reached a record high, reflecting sustained consumer interest, the service noted in an executive summary. “Meanwhile, the used EV market continued to grow, driven by affordability and more model options.

Continuing upturn

January marked the tenth month in a row during which American motorists purchased more than 100,000 new EVs, said Cox. And while the numbers were down from December that was no surprise considering normal seasonal fluctuations. It certainly would have been difficult to keep up with the holiday season surge which marked an all-time high.

January marked the tenth month in a row during which American motorists purchased more than 100,000 new EVs, said Cox. And while the numbers were down from December that was no surprise considering normal seasonal fluctuations. It certainly would have been difficult to keep up with the holiday season surge which marked an all-time high.

A “month-over-month sales decline was expected,” noted Cox.

One key question industry analysts and planners are asking is whether the strong EV sales of recent months were a fluke or an underlying trend. But there’s another big question: does this simply mark a surge by EV buyers hoping to take advantage of the federal tax credits President Donald Trump is promising to put an end to?

Used EVs also gain momentum

Demand for used EVs has lagged over the last several years, one reason why vehicles like the Tesla Model 3, Hyundai Ioniq 5 and Ford F-150 Lightning have seen sharp declines in residual values. But things might be improving, at least from a seller’s standpoint, Cox reported.Used EV sales rose 3.5% during January, to 26,933, marking the second-highest sales total ever. That was when compared to December. Compared to January 2024, however, the figure was up 30.5%.

Used EV residuals still lag comparable gas models, but the more demand grows, experts anticipate, the smaller the gap will grow.

More EV News

- Ram Again Delays Launch of 1500 REV Pickup

- First Drive: 2025 Hyundai Ioniq 5 Gets More Range, New Off-Road XRT Package

- BMW Drops Plans for Producing Mini EV in UK

The top sellers

Not surprisingly, Tesla remained the best-selling brand when it came to EVs in January, though its market share continues to decline as the automaker faces increasing competition and a growing backlash in response to CEO Elon Musk’s controversial role in the Trump administration.

Among new EVs, the top five models — Tesla Model Y, Model 3, Volkswagen ID.4, Tesla Cybertruck, and Honda Prologue – accounted for 54% of the overall market. What was a surprise to some observers was the strong rebound by the VW ID.4, even while the Hyundai Ioniq 5 slipped out of the best-seller list.

In terms of used EVs, Cox listed the five top-selling models as: the Tesla Model 3, Model Y, Model S, Chevrolet Bolt, and Ford Mustang Mach-E. From a brand perspective: Tesla, Chevrolet, Mercedes-Benz, Ford, and Nissan, though Mercedes-Benz posted the strongest year-over-year gain, a 54% increase in demand.

Where are the deals?

The average transaction price for the typical new EV – which factors in MSRP, options and discounts – came to $55,614 in January. That’s almost exactly $7,000 more than what motorists paid for gas models, Cox reporter. The EV ATP was up 0.9% from December – but marked a 1.4% decrease compared to January 2024. Credit the fact that incentives, such as cashback and subsidized loan deals were up 48.6% year-over-year.

Used EV ATPs came in at $37,476 in January, said Cox, a 1.7% increase from December, but a 5.1% decrease year-over-year, reflecting those higher incentives.

The biggest incentives on new models, it reported, were offered by Volkswagen, Subaru, Kia, and Nissan. On average, they offered givebacks equal to 36.2% of their average transaction prices. In terms of used EVs, Cox said in its summary, “Ten brands (Porsche, Toyota, Chevrolet, Jaguar, Mazda, Volvo, Mini, Lexus, Nissan, and Subaru) had listing prices at or below those of their internal combustion engine (ICE+) models. Additionally, 39.4% of units sold were priced under $25,000.”

![2023-Chevrolet-Bolt-driving[1]](https://headlight.news/wp-content/uploads/2023/09/2023-Chevrolet-Bolt-driving1-300x209.jpg)

0 Comments