Looking for a good deal on a used vehicle? The price for a previously owned Tesla Model S posted the industry’s biggest year-over-year decline, according to dealer sales records. Tesla products, on the whole, have plunged in value as backlash grows to CEO Elon Musk’s role in the Trump administration. Headlight.News has more.

Used car prices are on the rise again after briefly leveling off following a COVID-driven surge. But there are still bargains to be found, especially if you’re in the market for a previously owned Tesla.

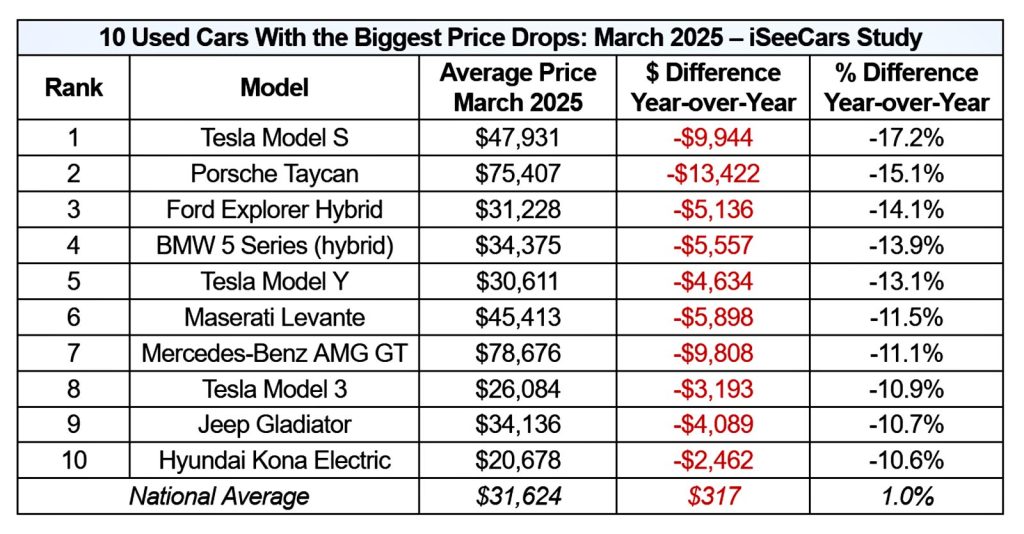

The automaker’s flagship sedan, the Model S, experienced the biggest percentage drop in price of any used vehicle on sale in the U.S. during March, a 17.2% year-over-year decline. On the whole, the Tesla brand saw a 10.1% dip in resale value last month, according to a new study of dealer data by iSeeCars.

Tesla’s plunge comes at a time of growing backlash aimed at CEO Elon Musk and his role as the Trump administration’s head of the Dept. of Government Efficiency. Other studies have found a large increase in the number of Tesla’s taken in on trade by U.S. auto dealers over the last several months.

By the numbers

According to the new study, the typical used Tesla Model S was priced at $47,931 during March. That was down $9,944 from a year earlier, a 17.2% reduction.

According to the new study, the typical used Tesla Model S was priced at $47,931 during March. That was down $9,944 from a year earlier, a 17.2% reduction.

The decline in value was even greater from a dollar standpoint for the Porsche Taycan, though it was smaller on a percentage basis. A typical Taycan was priced at $75,407 last month, down $13,422, or 15.1%.

Two other Teslas landed on the list, the Model Y posting the fifth-largest decline in value. At $30,611, it was off $4,634 year-over-year, or 13.1%. And the Model 3 was eighth on the list, at $26,084, a $3,193, or 10.9% dip. The Tesla Model X was in the top 20 nameplates with the biggest loss in value, according to iSeeCars.

When all Tesla trade-ins are factored in, the automaker also saw the largest decline in price among all brands in the U.S. The typical used Tesla went for $31,421 in March, off $3,541, or 10.1%, year-over-year.

Tesla backlash

Industry analysts warn that Tesla’s plunging residual values may not have hit bottom. The company saw a major downturn in first-quarter sales, reflecting lower demand driven both by rising competition and increased backlash to CEO Musk’s swing to the political far right.

Industry analysts warn that Tesla’s plunging residual values may not have hit bottom. The company saw a major downturn in first-quarter sales, reflecting lower demand driven both by rising competition and increased backlash to CEO Musk’s swing to the political far right.

Whatever the reason, it’s not only those who might have been thinking about buying Tesla products who are backing away. Recent months have seen a surge in the number of Tesla trade-ins, according to data gathered by tracking service Edmunds.com. A year ago, used Teslas made up just 0.4% of the total number of vehicles being traded in at U.S. dealers. That surged to 1.4% during the first half of March and Edmunds expects that rise to continue moving forward.

Further straining trade-ins: Tesla has been offering a variety of incentives, including lower prices, to try to perk up sales. But such moves typically have the effect of lowering residual values.

More Tesla News

- Tesla’s New Entry EV Expected to Debut in June

- Musk Returning to Focus on Tesla

- Tesla Q1 Earnings Fall 70%

Used EV prices take a hit

The charts, shown here, indicate that while Tesla is facing a particularly serious setback in the used market, electrified vehicles, on the whole, are losing value.

Of the 10 models that lost the most value last month, five are all-electric, including the three Teslas, the Porsche Taycan and the Hyundai Kona. The latter also is available in hybrid form, and two other models showing major declines were the Ford Explorer Hybrid and BMW 5-Series Hybrid.

The Jeep Gladiator, number nine on the model list, is available in both gas and plug-in hybrid form. It is, in fact, the best-selling PHEV on the U.S. market.

“Nine of the top 20 used cars with the biggest year-over-year price drops are alternative-fuel vehicles, including seven EVs and two hybrids,” analyst Karl Brauer wrote in a summary of the study.

0 Comments