The auto industry is in the midst of the most unsettling shake-up its seen in more than a century and that’s likely force radical change in not only what products manufacturers bring to market but how and where they sell them. For one thing, Detroit automakers should consider pulling out of China, said Bank of America analyst John Murphy as part of his annual “Car Wars” study.

As Chinese domestic brands, such as BYD, gain traction it is becoming less of a profitable market for Detroit and other foreign manufacturers.

Only a few years ago, China had become the single largest market in the world for Detroit automakers. But GM’s unexpected, $100 million loss there during the first quarter came as a warning shot.

With the rise of domestic Chinese brands – often backed by government authorities – like Geely, BYD and Great Wall, however, U.S. manufacturers now should seriously consider shifting their focus away from that Asian market, even leaving China entirely, said John Murphy, the lead auto analyst for Bank of America Research.

Detroit’s Big Three should instead focus on core business operations, namely the gas-powered pickups and large SUVs, that will help generate the revenues needed to cover the costly transition to electric drive technology, said Murphy during a presentation of his annual “Car Wars” study.

“Problems never seen before”

The study described the next four years as “the most uncertain and volatile (period) in product strategy ever,” Murphy telling Headlight.News that manufacturers haven’t faced as many challenges since the very earliest years of the auto industry.

They’re dealing with “problems never seen before.”

That includes not only the shift to electric drive technology but the arrival of new competitors, both foreign and domestic.

Sales up, profits down

On the positive side, Murphy said, the industry is recovering from the hit it took during COVID. In the U.S., sales dropped to Great Recession levels, barely 10 million, during the first year of the pandemic. This year, the number should be at or above 15 million, said Murphy, forecasting “a very significant increase to about 18 million units by 2028.” Globally, he added, the industry is getting back on track to reach anywhere from 80 to 90 million this decade.

Ironically, COVID and subsequent parts shortages led to a period of high profitability as vehicle prices soared to record levels. Dealers, in particular, saw their earnings roughly triple to more than $6,000 per vehicle, according to industry data.

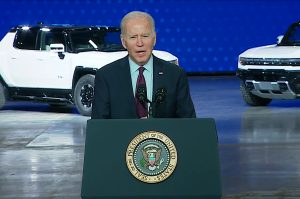

Domestic automakers would do better to focus on the products and markets where they make big money, said analyst John Murphy.

But there’s growing pushback from buyers, reflected by the fact that many Americans no longer can or will buy new vehicles. And that will put margins under increasing pressure, both for manufacturers and dealers.

More Auto Industry News

- GM Loses $100 Mil in Once-Profitable Chinese Market

- Chinese Imports Pose “Extinction-Level” Threat

- Biden Announces Sweeping Tariffs on Chinese Goods

The electric era

That’s a potentially serious problem considering the transformation the industry is facing on a technical front. EV sales are running slower than anticipated this year and that is leading many manufacturers to rethink their strategies, Murphy noted.

Ford has pushed back the opening of its Blue Oval City factory – and the next-generation F-150 Lightning.

Many are stretching out or canceling EV programs. Some are shifting the mix to bring in more hybrids and plug-in hybrids. The number of all-electric models due out between 2025 through 2028 is 4% lower than what was foreseen in last year’s Car Wars study.

Still, Murphy said he is convinced the transition to battery-electric vehicles is irreversible. EV market penetration is forecast to reach 11% this year 2024, 20% by 2025 and 25% by 2027. And automakers are going to need to devote substantial resources to get there.

In the negative

The big concern is that they will continue to lose money in at least the mid-term. And that’s all the more of a concern as they face off against the profit machine known as Tesla, as well as the increasingly aggressive Chinese. China’s auto industry barely exported any vehicles at the beginning of this decade. That hit 5 million last year and is expected to rise quickly – though new tariffs in the U.S. and the EU could provide a sizable speed bump.

Tesla has its own problems, said Murphy, noting its unexpectedly weak first-quarter sales and earnings. At least some of that may be due to CEO Elon Musk’s increasingly strident turn to the political right, amplified by his social media service X, said the analyst. But the automaker has also allowed its core models to get old – and has been far too slow to expand its line-up.

Tesla and Detroit’s Big Three must learn from each other, said Murphy.

Lessons to learn

Tesla, he explained, appears ready to adopt a more traditional product model by adding “more top hats,” industry-speak for additional body styles based off the same platform. That minimizes costs while giving consumers more options to choose from.

Manufacturers like GM, Ford and Stellantis, on the other hand, must accelerate efforts to bring out lower-cost platforms that can make them competitive in the EV market.

Right now, Tesla’s component costs are about $17,000 less than its Detroit rivals who “are going to need to take down costs on their (EVs) very dramatically,” said Murphy.

Take it slow, do it right

Somewhat surprisingly, Murphy said established automakers shouldn’t push to rapidly build up EV sales volumes right now. They’re better off waiting until those new platforms are ready.

The first of those new designs are just coming to market. GM, for example, will launch nearly a half-dozen models in 2024 based off its Ultium platform and batteries. Stellantis is rolling out a handful, such as the Jeep Wagoneer S, using its new family of STLA platforms. Ford is still several years away from introducing its own new EV platforms – and has pushed back by a year the opening of its Blue Oval City assembly complex near Memphis where key products will be assembled.

Murphy said he doesn’t see Detroit really geared up to be a competitive force in EVs until 2028, at the earliest, and perhaps not until 2030. In the meantime, the automakers need to rationalize their spending elsewhere. And, with China no longer the profit machine it once was, Murphy says it may be time to simply cede that market to domestic Chinese and other global players.

What do I have to do for financing

The best move is to connect with your bank and other lenders, even try AAA, BEFORE you go to buy a vehicle. Know what’s available so a dealer can’t stick you with bad rates or terms.

Paul E.

Financing