With the typical new vehicle now costing nearly $50,000, millions of American motorists have been priced out of the market. But prices for “previously owned” products have also soared to record levels and that’s pushing many used car customers into older, less well-equipped vehicles.

For many buyers, even those who could afford something new, going with a used car has become an option of choice, because of the way new models depreciate as soon as they’re driven off the showroom lot. In the past, there were substantial savings to be found, especially in nearly new off-lease vehicles. Not anymore, according to a study by iSeeCars.

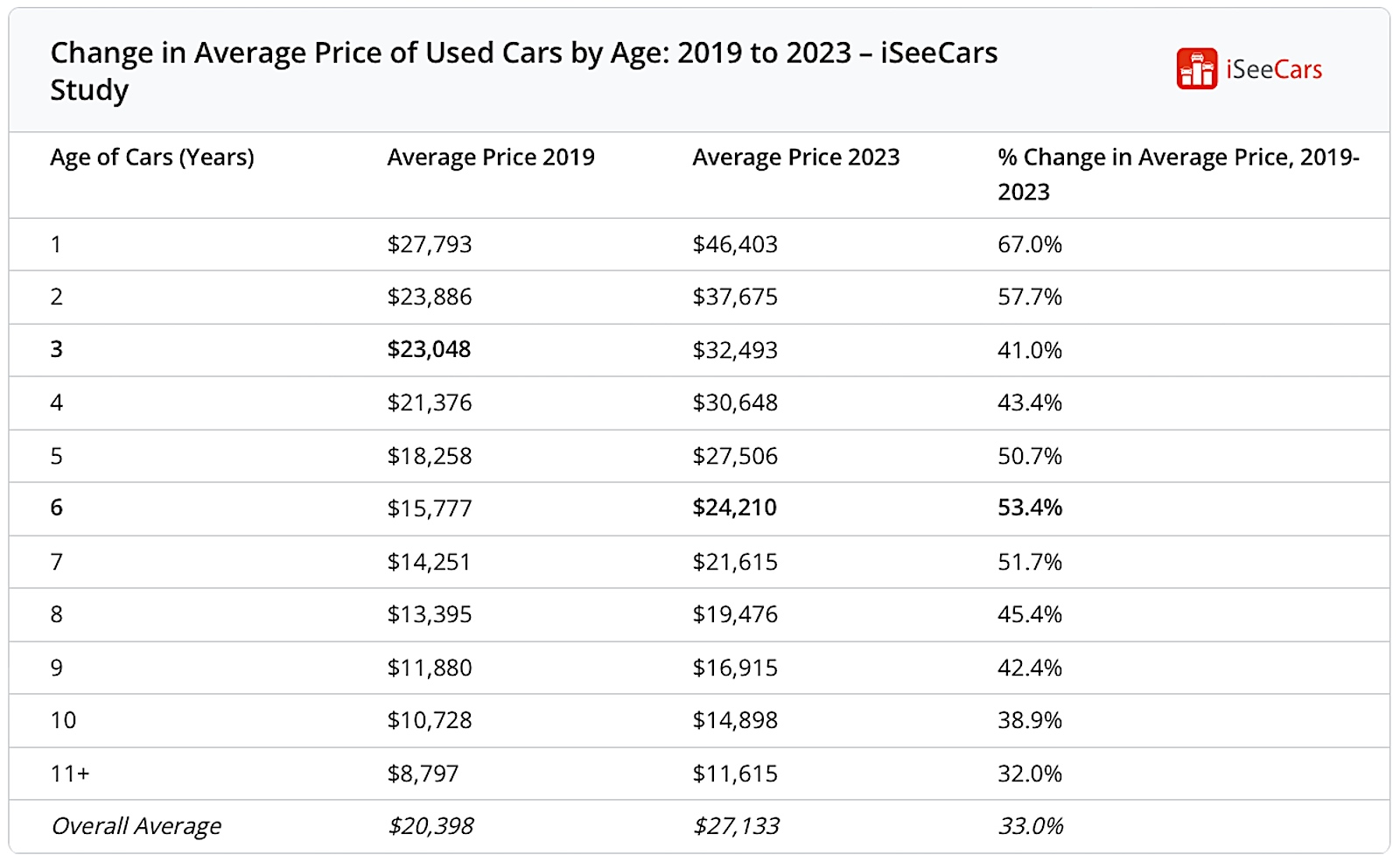

Where the typical three-year-old used model went for $23,000 as recently as 2019, that’s now jumped to $32,493 — a $9,493, or 41%, increase in just four years, the study shows.

COVID and Semiconductor chips

Credit — or blame, if you prefer — COVID and subsequent semiconductor shortage. As the pandemic rapidly spread around the world, automakers were forced to halt production for several months. Even before they could get factories up to speed, they were hit by the proverbial double-whammy.

The shortage of chips caused on-again/off-again plant closures impacting virtually all automakers, large and small. As 2022 drew to a close there were barely 1 million vehicles in U.S. dealer inventories, according to J.D. Power, barely a third of the normal 3 million.

That meant millions of potential buyers cou

ldn’t find the products they wanted, many simply choosing to keep running their old models. Where new vehicle sales reached nearly 17.1 million in 2019, that plunged to 14.7 million during the first year of the pandemic, bouncing back only slightly in 2021. Last year, sales totaled 13.7 million, the lowest figure since the Great Recession.

Lower new vehicles sales mean fewer automobiles going into the used car fleet. And that doesn’t fully reveal the depth of the problem. Since COVID struck, millions fewer motorists have leased their vehicles. That means substantially fewer 1-, 2- and 3-year-old products now are available on the used car side.

Supply-side economics

That’s where supply-side economics come into play, said iSeeCars Executive Analyst Karl Brauer.

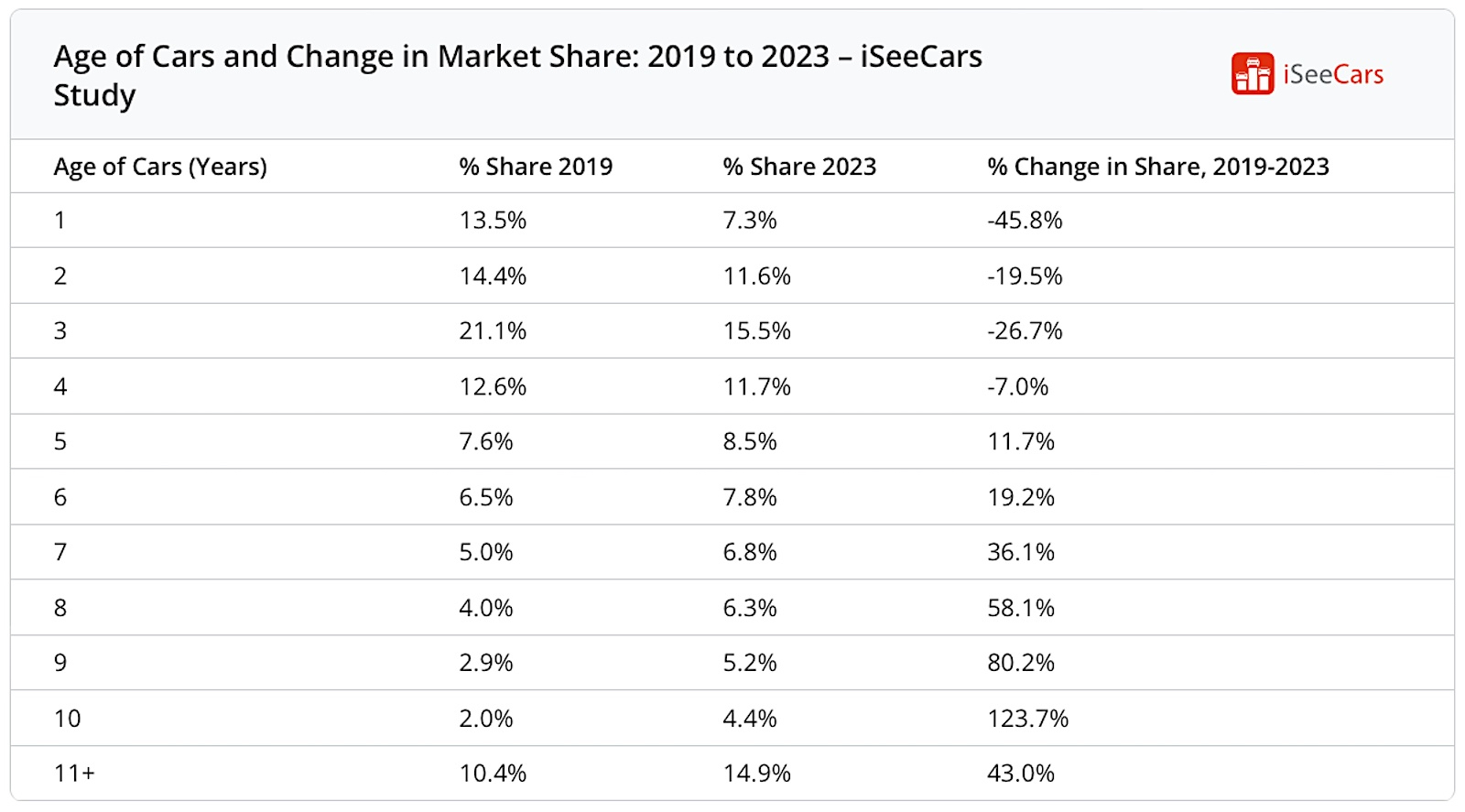

“The impact of restricted new car production during the pandemic has come home to roost in the used car market,” Brauer said. “With 1- to 3-year-old used car supply down between 20% and 45%, buyers that previously shopped for late model year used cars now have to spend much more or consider much older vehicles.”

For someone still looking to pay $23,000 for the typical used vehicle, they’d still have to up their budget to more than $24,000 today — and that’s to get into a comparable, 6-year-old model.

The alternative would be to downsize, say, from a well-equipped, 3-year-old Hyundai Santa Fe to a smaller, less well-equipped Hyundai Tucson.

More money, more miles on the odometer

In 2019, vehicles no more than three years old accounted for fully 49% of the used market. Today, they barely make up 34%. The older the vehicle, the more demand has grown since the pandemic began, according to the iSeeCars study.

Another way to look at what’s happened: in 2019 the average 5-year-old vehicle cost $18,258. You’d now have to opt for an 8-year-old model to get in at under $20,000.

“The 2019 budget that purchased (the typical 3-year-old vehicle) now buys a 7- to 9-year-old version of that same model,” said Brauer. “Given that the average car is driven between 10,000 and 15,000 miles a year, these cars are not only more than twice as old, but have between 40,000 and 100,000-plus more miles — for the same money.”

Plus and minus

Making matters worse, shoppers now have to contend with the highest interest rates they’ve seen in years, something that can add thousands to the ultimate cost of buying any new vehicle.

On the plus side, U.S. new vehicle sales have been rebounding in 2023, though they remain well behind 2019 levels. As a result, analysts caution that the number of reasonably new, previously owned vehicles might not reach normal levels until sometime during the second half of this decade.

0 Comments