Tesla delivered 485,000 vehicles during the fourth quarter, bringing total sales for the year to 1.81 million, an all-time record. But the automaker fell short of the 2 million target CEO Elon Musk set early last year. And it has BYD, breathing down its neck, even though that major Chinese competitor has yet to enter the North American market.

Tesla didn’t hit its goal of a 50% increase year-over-year, but its 1.8 million vehicles was impressive.

Tesla delivered a record 1.81 million vehicles during 2023, a 38% year-over-year increase, while the third-quarter total of 485,000 deliveries another all-time high.

The Texas-based automaker remained the overwhelmingly dominant player in the U.S. EV market, though it did feel the impact of slowing sales, as well as the arrival of numerous new competitors.

It’s China’s BYD that could have Tesla CEO Elon Musk looking over his shoulder a lot these days. The largest of that country’s EV manufacturers delivered a total of 3 million electrified vehicles in 2023, over half of those all-electric. And, for the fourth quarter, BYD outsold Tesla, at 526,409, the Chinese competitor reported Tuesday.

A narrow miss

Tesla’s deliveries totaled 1,808,581 for all of last year, with production about 37,000 higher. That missed the 2 million target Musk set a year ago. So did the 38% year-over-year growth rate. Though that’s a number no conventional automaker came close to, it’s still short of the 40% figure set in 2022, and the 50% annual increase that is Tesla’s internal goal.

Fourth-quarter deliveries of 484,507 EVs beat the consensus analyst forecast of 477,000, compiled by StreetAccount. “This was a clear win for Musk and Tesla as hitting 1.8 million vehicles for 2023 was a major achievement in a choppy macro for EVs,” Wedbush Securities analyst Dan Ives advised clients on Tuesday.

Tesla’s original products, the Models S and X, accounted for 22,969 deliveries during the most recent quarter, though they still overwhelmed much of the competition, electric or gas, such as the Mercedes-Benz S-Class and its EV alternative, the EQS.

The big numbers came from Tesla’s two more mainstream offerings, the Models 3 and Y which, collectively, generated 461,538 deliveries. The company doesn’t break out sales by individual models but, in October, Musk said he expected the Model Y SUV to “be the bestselling car on Earth, but not just in revenue, but in unit volume.”

(Most of) the competition struggles

Tesla’s U.S. market share has steadily fallen over the last four years, even as the segment has grown about eight-fold. That reflects the influx of dozens of new competitors – bringing a collective total of more than 50 new all-electric models to market in 2023 alone. For the first nine months of the year it accounted for 50% of the EVs sold in the States, down from 65% during the same period in 2021.

But none of those competitors have come close to dislodging Tesla’s grip on the sales charts. In recent months, the Chevrolet Bolt EV — which went out of production at the end of the year — was a far-distant third, well behind the Tesla Models 3 and Y.

More Tesla news

- Tesla among automakers losing EV tax credits this year

- After repeated delays, Tesla finally delivers first Cybertruck

- Tesla recalls over 2 million EVs to fix Autopilot defect

BYD comes on fast

It’s only in China that Tesla is seeing any serious competition, most notably from BYD. Unlike its American rival, it produces a mix of pure-electric and plug-in hybrids. For the full year, BYD sold 3 million vehicles, including 1.6 million EVs and 1.4 million PHEVs.

But it really gained momentum during the fourth quarter, delivering 526,409 EVs alone, about 9% more than Tesla recorded.

And while Tesla is now a global retailer — backed by assembly plants in China and Germany, as well as two in the U.S. — BYD is primarily focused on Europe and Asia. After promising for a decade, it has yet to set up a North American distribution base.

“There’s a new sheriff in town,” wrote Michael Dunne, a longtime analyst following the Asian auto industry, noting, “No one can match BYD on price.”

For now, at least, Tesla doesn’t have to worry much about that Chinese competitor. It still has numerous advantages, said Dunne. But it shouldn’t ignore BYD, by any means, “and everyone else who builds cars should be gripped by panic.”

Other challenges ahead

Even as BYD continues ramping up its own plans, Tesla faces growing competition around the world. In the U.S. market, in particular, at least 40 new all-electric models will debut in 2024, with similar numbers to follow through mid-decade, according to data compiled by Headlight.News.

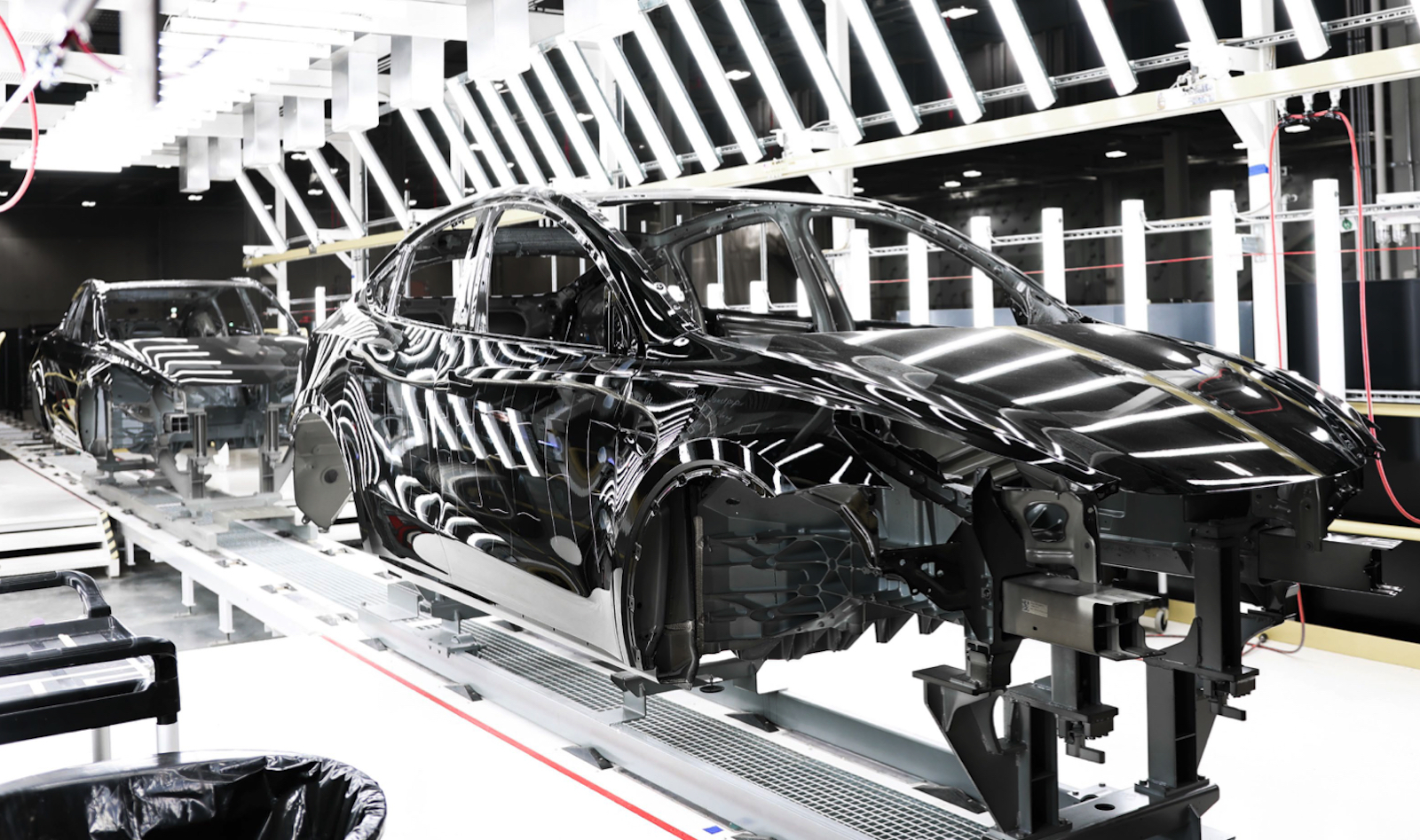

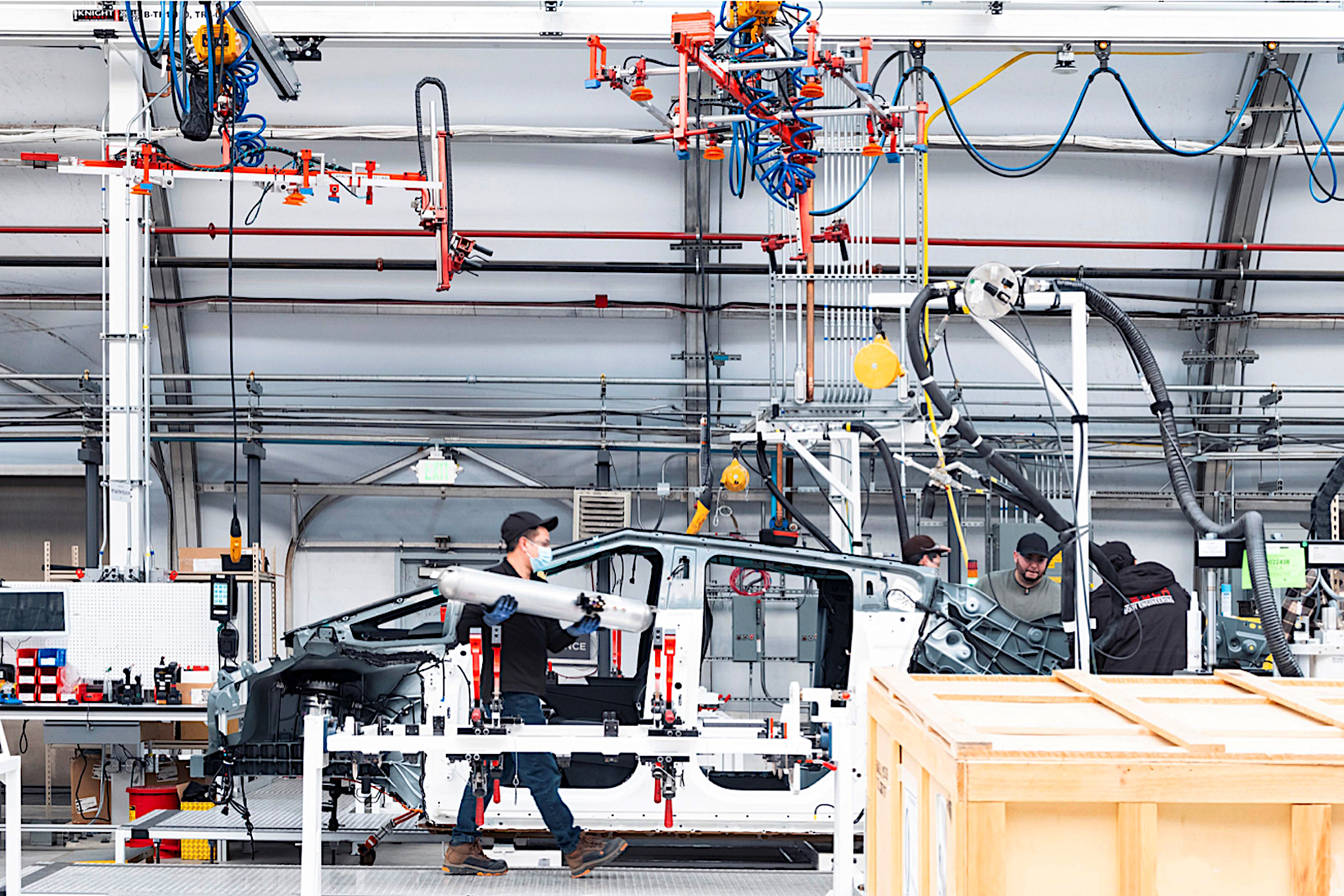

Tesla can’t come close to meeting sales expectations for the Cybertruck due to production bottlenecks at its Texas Gigafactory.

Tesla’s own rollout of new products has been slow. It launched the Cybertruck — two years behind schedule — in November. But sales measured in the dozens for the remainder of the year and are expected to ramp up slowly in 2024. The Model 3 will get a modest update this year, as well, but a new entry product, referred to as the Model 2 by industry-watchers — is still at least a year away.

Meanwhile, Tesla was one of a number of manufacturers hit by revised government mandates on Jan. 1. That means it has lost the $7,500 tax credits until now offered on the Standard Range version of the Model 3.

What happens in 2024 is far from certain. The North American EV market is clearly flattening out, according to J.D. Power data chief Tyson Jominy. But Tesla today counts on Europe and Asia, as well as some other global markets, for a growing share of its sales.

Investors remained relatively unmoved, either way by the Q4 numbers, Tesla shares down a bit less than 1% in mid-afternoon trading, at around $248.

0 Comments

Trackbacks/Pingbacks