Tesla CEO Elon Musk has repeatedly promised to bring more affordable EVs to market but has so far failed to pull it off. Now, however, a report indicates the Texas-based automaker is getting ready to follow through with a compact crossover that could be available by mid-2025 at a starting price of $25,000. More from Headlight.News.

Tesla’s looking to build a cheaper EV, reportedly coming in at about $25,000 — before any federal tax credits.

Among the many reasons why EV sales growth slowed down this past year, the lack of affordable options frequently catches blame. The average price of an all-electric vehicle is around $60,000, according to industry data. Relatively few products are available at under $35,000, and the handful under $30,000 sacrifice range and features.

Tesla CEO Elon Musk has repeatedly promised to deliver more affordable offerings, starting with versions of the Model 3. But the automaker so far has failed to deliver — its lowest-priced offering now a $38,990 version of that sedan. But there more be good news for buyers on a budget.

Quoting “four people familiar with the matter,” Reuters reports that Tesla is gearing up its suppliers for an entry-level model that would start rolling out in mid-2025.

Project Redwood

According to those sources, said Reuters, the project is codenamed “Redwood” and is targeting a base price of $25,000. It’s unclear if the new model would qualify for revised federal EV tax credits under the Inflation Reduction Act, but if it were that could bring the effective price down as low as $17,500. That would make the Tesla offering one of the lowest-priced vehicles on the U.S. market, whether using battery power or an internal combustion engine.

Reuters quotes two of its four sources as specifically saying the new model will be a compact crossover.

Tesla — which no longer maintains a media relations department — failed to respond to queries by either Reuters or Headlight.News.

Elon Musk has been promising a sub-$25K model for several years now, but it appears closer to reality now.

Details TBA

A number of questions are raised by the report, starting with details about the Redwood vehicle’s battery pack size and range. Batteries make up the single-largest cost for EV manufacturers, running as much as 40% of the price tag. Some of the lower-cost models that have been introduced, such as the Mazda MX-30, attempted to hold down costs by reducing the size of the pack. But today’s buyers have largely rejected vehicles that don’t deliver at least 200 miles per charge.

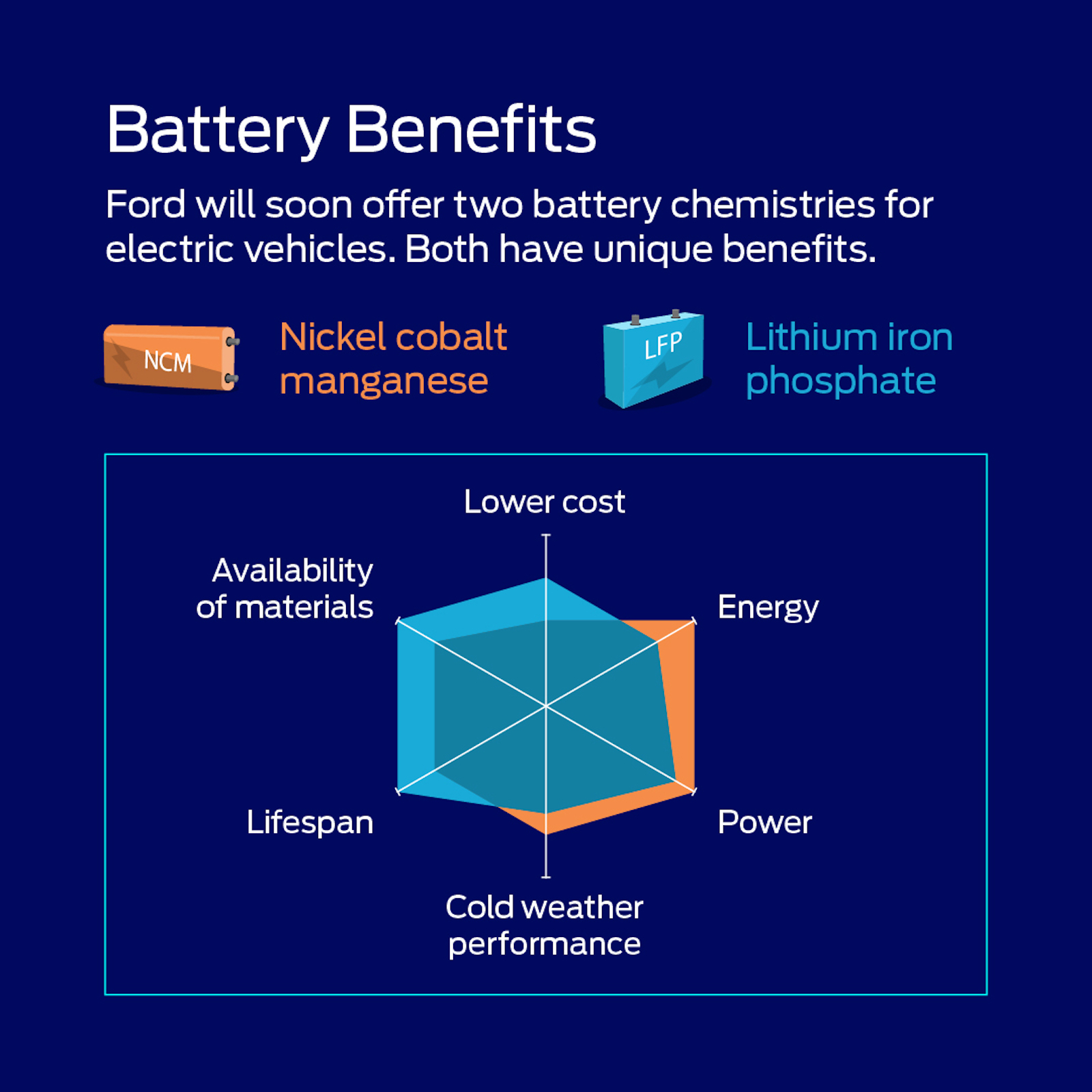

As with the more affordable version of its Models 3 and Y, Tesla would all but certainly opt to use lithium-iron-phosphate, or LFP, batteries, rather than more familiar lithium-ion chemistry, one source, talking on background, told Headlight.News. While LFP cells don’t offer quite as much range, they could still deliver something close to 200 miles while bringing down an entry model’s cost, the source said.

How much of a market Tesla sees for Redwood also is uncertain. Reuters’ sources indicate the automaker has reached out to potential suppliers for bids, and is telling them it expects to produce 10,000 of the compact crossovers. That would be an unusually low volume, however, especially for something all new and likely carrying a much smaller profit margin than anything Tesla currently produces.

More Tesla News

- Where’s My Affordable EV? Tesla, GM and Other Automakers Claim it’s Coming

- Tesla Readying $25K (Almost) for Production

- Tesla Model Y is First EV to Win European Sales Crown

Tesla aims to slash production costs

Tesla is one of the few manufacturers currently making money on EVs. Last autumn, Ford officials said during an earnings call the company lost $37,000 for each battery-electric vehicle sold.

But Tesla’s industry-leading margins have slipped during the last year as the automaker enacted a series of price cuts on vehicles like the Models X and Y. And even the use of LFP batteries wouldn’t obviate the challenges the carmaker might face with a vehicle like the Redwood crossover.

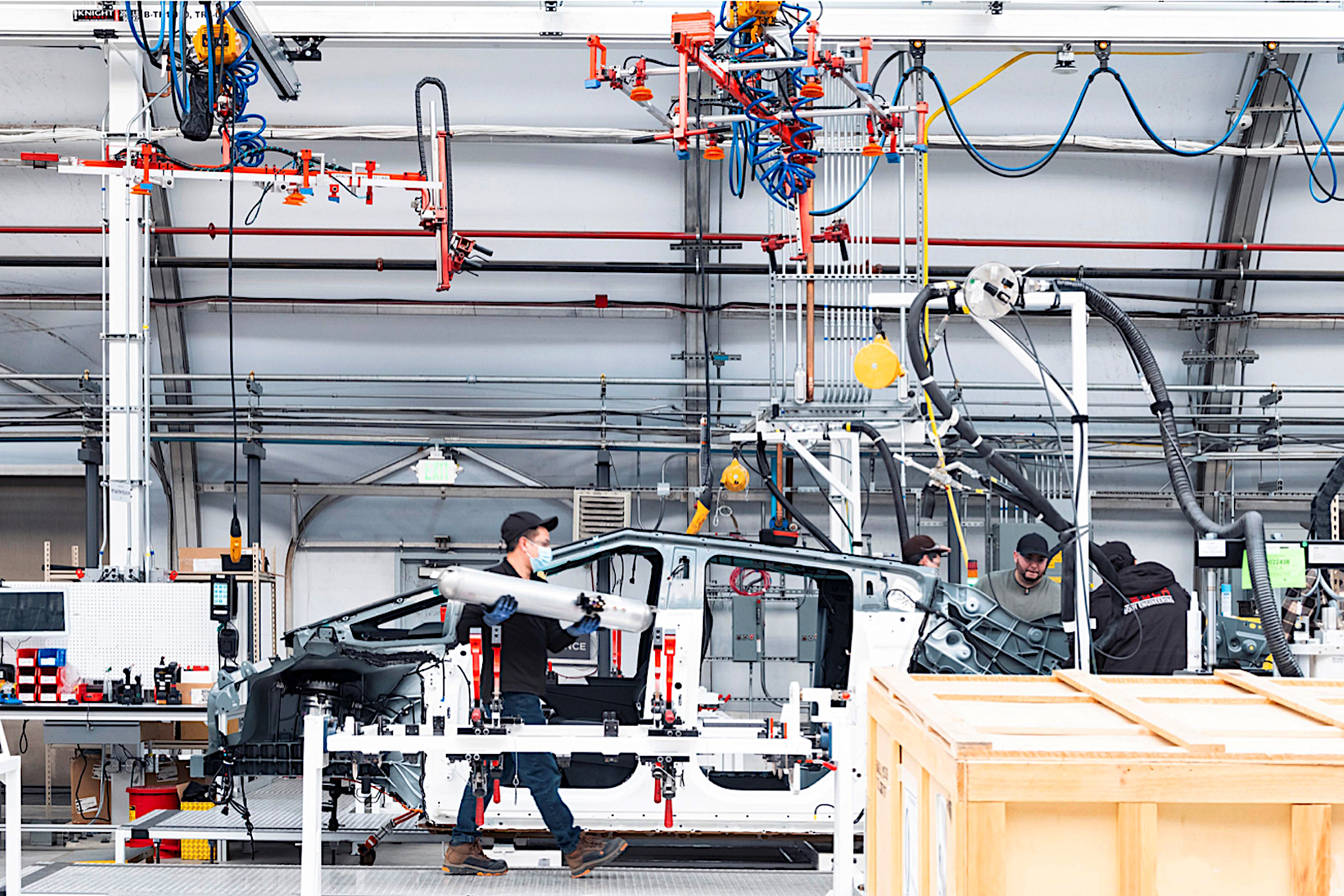

The company has come up with some novel ways to reduce production costs. It now uses so-called “mega-castings,” single cast aluminum structures that replace body and chassis components that might otherwise require stamping and then welding together dozens of individual steel pieces.

In May, Musk hinted that Tesla was working on two new high-volume products — with potential sales reaching 5 million annually. And they would introduce new production processes to slash costs substantially.

“Both the design of the products and manufacturing techniques are head and shoulders above anything else that is present in the industry,” Musk said during Tesla’s 2023 shareholder meeting.

Missed targets

Since its very beginning, Tesla has made a series of overly optimistic pronouncements, including earlier promises of an affordable EV. And it has routinely missed planned production dates. The recently launched Cybertruck, for example, is about two years behind schedule.

“They have been overly optimistic on most of their new product launches. Volume output is more likely to begin in 2026,” one of the sources told Reuters.

Tesla’s kicked off production of the Cybertruck during the fourth quarter of 2023. The use of large stampings help get it off the ground.

Another reason to question the target date is the use of the new manufacturing technology Tesla will rely on to lower its own production costs. It ran into significant delays — which Musk described as “production hell,” launching the Model 3. And the compact crossover’s platform, codenamed “NV9X,” could pose similarly hellish challenges.

Significant opportunities

But it could prove worth it if Tesla can pull the Redwood project together. After increasing eightfold from 2019 to 2023, EV sales growth in the U.S. slowed to a crawl during the second half of last year. And while it delivered record volumes, Tesla not only fell short of its original target but saw its market share tumble as more competitors entered the market.

In Europe, it fielded the bestselling vehicle, gas or electric, but it is facing an onslaught of new, low-cost competition from Chinese rivals like BYD. It’s facing even more pressure in China, where it operates a factory in Shanghai.

Coming in with a reasonably equipped and affordably priced offering that meets at least minimum consumer range expectations could be the game plan that maintains Tesla’s position as EV king-of-the-hill.

0 Comments