Rivian announced it will slash both its corporate staff and production this year after reporting more than $1.5 billion in losses for the final three months of 2023. Even as it prepares to unveil an entirely new family of battery-electric vehicles, CEO RJ Scaringe warned the nascent automaker “is not immune” to the headwinds battering the U.S. EV market after four years of record growth. Separately, EV startup Lucid also forecast flattening sales after reporting worsening losses.

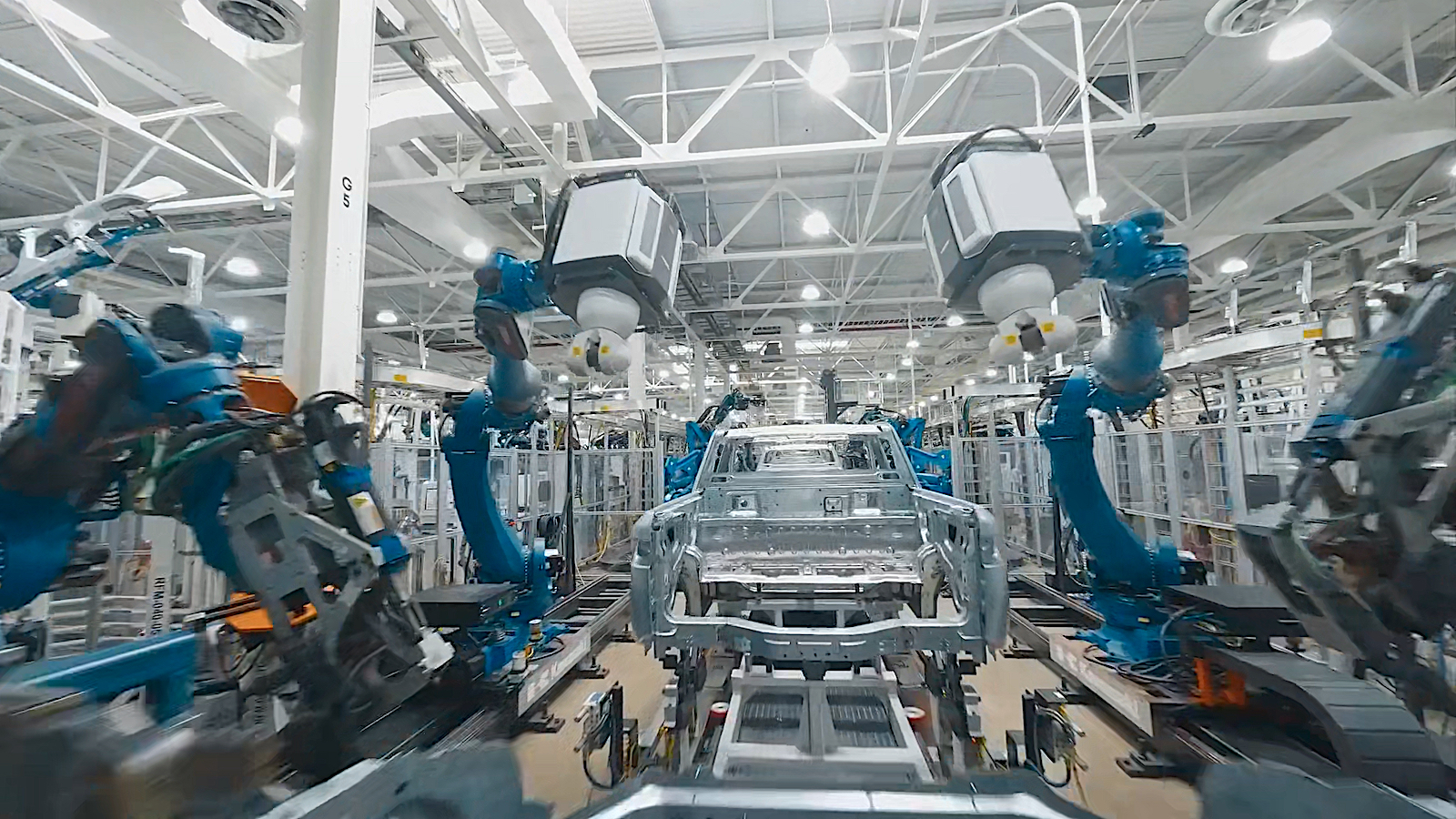

Rivian will close its Illinois plant for several weeks during the second quarter to focus on cost-cutting.

Tesla “wannabe” Rivian Automotive delivered a mix basket of news as it announced third-quarter results late Thursday. With losses totaling $1.52 billion, CEO RJ Scaringe outlined a series of steps aimed at trimming expenses, among other things, by cutting the company’s salaried staff by 10%.

The company also warned that production is likely to hold flat in 2024, the automaker last year delivering 57,000 vehicles. It originally was targeting an increase to around 80,000 R1T pickups and R1S crossovers.

Headwinds

Rivian delivered its fourth-quarter results at a bad time for the EV market. After surging eightfold from 2019 to early 2023, sales growth has largely flattened out in recent months, according to J.D. Power, and it’s unclear if or when demand will recover.

That has led to a flurry of activity among automakers, including Ford, General Motors, Volkswagen and others, who have begun delaying or scaling back their EV programs.

“Our business is not immune to existing economic and geopolitical uncertainties, most notably the impact of historically high interest rates, which has negatively impacted demand,” Scaringe said during Rivian’s earnings call.

For the most recent quarter, Rivian posted total revenues of $1.32 billion, roughly doubly the $663 million during the same period a year earlier. Deliveries of its two retail models, as well as the EDV delivery van developed for Amazon Prime service rose by nearly 17%, to 13,972 for the full year. Nonetheless, Rivian posted full-year 2023 losses of $5.43 billion.

More financial news

- GM delivers unexpectedly strong earnings for Q4

- Tesla misses target in Q4; Musk reveals plans for “affordable” EV

- Ford goes into the red in Q4 but pulls a full-year profit

Wall Street balks

The news sent many investors scurrying to sell off their stock. At one point during after-hours trading the stock was off as much as 16%. The downward trend continued once the market reopened on Thursday, the stock sliding towards $11 a share, down from as much as $17 earlier in the week. Rivian’s 52-week high was $28.06.

The company also warned that production is likely to hold flat in 2024, the automaker last year delivering 57,000 vehicles.

But some analysts believe the worst may be behind the company. An advisory from Bank of America Global Research said that despite the cut in Rivian’s production forecast the rest of the numbers released this week were “roughly in line” with its expectations. If anything, BoA forecast Rivian’s losses should be halved in 2024, a key reason why it said it would “reiterate our Buy ratings.

Cutting costs, shoring up demand

Along with the job cuts, Rivian said it will shut down operations at its assembly plant in Normal, Illinois for several weeks during the second quarter to improve production efficiencies. It also will bring in new suppliers it believes will further help reduce costs.

With more competition coming into a weakening EV market, Rivian is looking for ways to build momentum. Earlier this month it announced price cuts on models equipped with new, lower-range batteries.

The company is also preparing to reveal an all-new line-up of smaller, less expensive products collectively known as R2. Rivian officials will debut the line-up on March 7 but it’s widely expected to follow the R1 pattern with both a smaller pickup and a smaller SUV. Production, however, won’t begin for another year at the second plant Rivian is building in Georgia.

CEO RJ Scaringe outlined a series of steps aimed at trimming expenses, among other things, by cutting the company’s salaried staff by 10%.

Lucid also disappoints

Another EV startup delivered disappointing news on Wednesday, California-based Lucid reporting losses widened to $654 million for the fourth quarter. For the full year, its net loss more than doubled to $2.83 billion versus $1.3 billion in 2022

Lucid also saw sales of its only product line decline in the most recent quarter. Buyers purchased 1,734 Air sedans, down from 1,932 a year earlier. The EV maker also forecast flat sales for 2024, though it has projected an upturn will begin with the launch of its second model line, the Gravity SUV later this year.

The news also sent Lucid shares tumbling. The stock has lost about 90% of its value since the company went public in 2021 as part of a SPAC merger.

Separately, Vietnamese EV maker VinFast reported a 3.4% increase in its fourth-quarter losses. But the company’s earning call took a generally upbeat tone, chairwoman Le Thi Thu Thuy forecasting global deliveries will nearly triple to 100,000 in 2024, up from 35,000 last year. It is in the process of expanding its line-up which, in the U.S. currently consists of just the midsize VF 8 SUV.

0 Comments