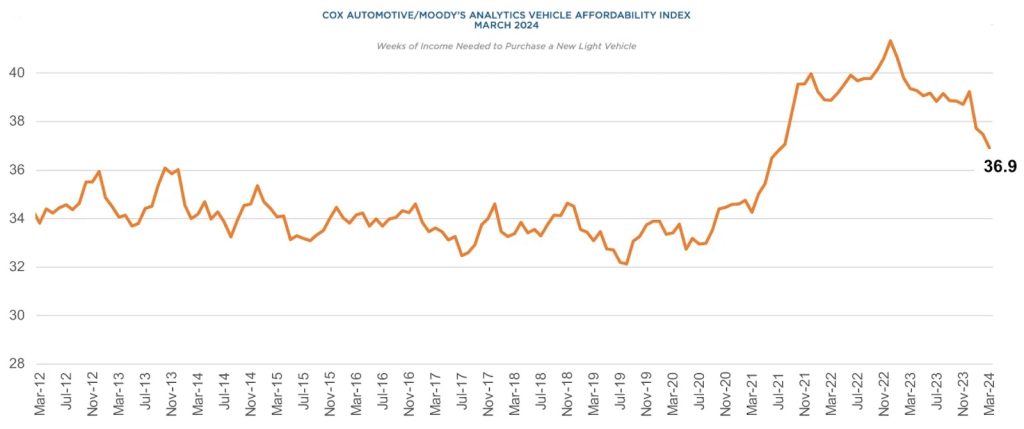

If you’ve been in the market for a new vehicle anytime in the past few years, the record-high prices have been enough to make you get back in your old car and go home and wait, hoping for a price drop. Well, prices have been falling for several months, including last month courtesy of the recent drop in interest rates.

The affordability of new vehicles improved in March, as the average monthly payment fell to $744 from $753 in February.

The affordability of new vehicles improved due to upticks in economic forces. Not only did interest rates decline, but income growth also continued in March. Another helping factor: incentives increase. The result is that monthly payments fell 1.2% to $744 in March. It was $753 in February. It reached a record high of $795 in December 2022.

Additionally, the median weeks of income needed to buy a new car, truck or SUV fell to 36.9 weeks from 37.5 weeks in February. All of this good news means the good times will keep rolling, right? Not so much.

“The positive moves were assisted by the first material decline in interest rates in over two years,” said Cox Automotive Chief Economist Jonathan Smoke. “However, given the move-up in rates so far in April, that decline is likely to be short-lived.”

Falling loan interest rates

The biggest factor in the improvement of vehicle affordability was the 15 basis point decline in typical car loan interest rates, which dropped to 10.47% in March, Cox analysts noted. The median income grew 0.3%, while the average new-vehicle transaction price declined 0.1%.

While most people shop for a monthly payment these days, what people are paying on average for a new vehicle accounting for all factors is a key element in tracking affordability. Known as the average transaction price, or ATP, if fell slightly in March.

The ATP of a new vehicle in the U.S. was $47,218, down 1% from March 2023 and down 5.4% from the market peak in December 2022. Still, new-vehicle prices in the U.S. remain higher by 15.5% compared to March 2021.

More Sales News

- March Auto Sales Look Strong — But Affordability Remains an Issue

- Hybrids, EVs Helped Prop Up March Sales — Except for Tesla

- Tesla Q1 Deliveries Decline as Competitors See Increases

Used vehicle sales

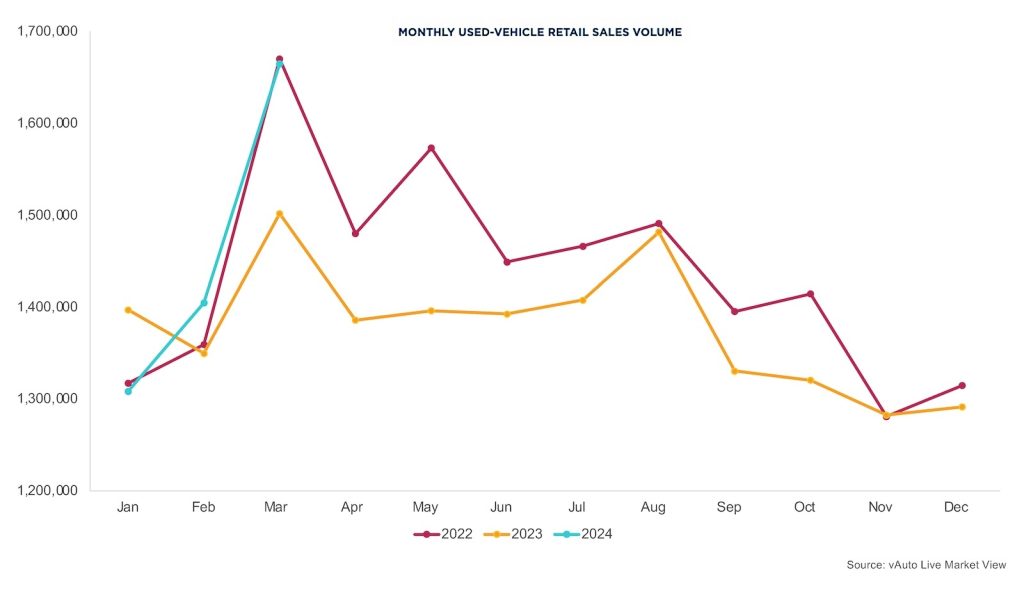

While new vehicle prices are falling, those cars are still pricey. Retail used vehicle sales jumped in March as people continue to look for good deals — and lower monthly payments. According to vAuto Live Market View data estimates, retail used-vehicle sales in March increased from February and were up by 18.5% month over month.

A total of 1.66 million used vehicles were sold at retail — from both franchised and independent dealers — during March, up 10.9% year over year and the highest volume since March 2022. In what is usually a high month for used-vehicle sales, sales in March reflected the seasonal trend. Days’ supply dropped to 44 at the beginning of March, down from a revised 53 at the beginning of February.

“As we move into spring, sales for used vehicles typically rise and we saw that trend continue this year with strong demand,” said Jeremy Robb, senior director of Economic and Industry Insights at Cox Automotive. “Sales for used vehicles picked up in February, continuing to increase for eight weeks in a row before peaking towards the latter half of March.

“Affordability matters more than ever to consumers and declines in used-vehicle prices help offset higher interest rates. Once tax return season got underway, many consumers had more income to use as a down payment, driving customers into retail dealerships.”

0 Comments