While growth in the battery-electric vehicle segment has slowed sharply this year, sales are rising fast for hybrids – and automakers like Toyota, General Motors, Hyundai Motor Group and others are forecasting demand could grow at a near exponential rate for plug-in hybrids and range-extenders – driven in part by revised federal emissions standards.

The first Stellantis application of the range extender system will be on the Ram 1500 Ramcharger. Jeep will follow later next year.

When the new Ram 1500 REV comes to market late this year, the all-electric pickup will quickly be followed by a second “electrified” model, the Ram 1500 Ramcharger. Like the REV, the Ramcharger’s wheels will draw power from a set of electric motors. But it will feature a smaller, 92 kWh battery pack – and an internal combustion engine that will be able to recharge those batteries once they start to get drained.

General Motors, meanwhile, has a “very solid plan” to add more conventional plug-in hybrids to its line-up, starting in 2027, CEO Mary Barra said CEO Mary Barra during an industry conference last week. Barra wouldn’t disclose what products that PHEVs will appear on – but the technology is widely expected to be used on some of GM’s larger pickups and SUVs.

A handful of manufacturers currently offer plug-based hybrids, including Mercedes-Benz, BMW, Honda, Toyota and Hyundai. Until now, they’ve made up barely 1% of the U.S. new vehicle market. But that figure is expected to grow rapidly over the next several years, said Sam Abuelsamid, principal auto analyst with Guidehouse Insights. And a number of manufacturers have begun shifting focus to plug models.

Why now?

The original Chevrolet Volt was the world’s first mass-market plug-in hybrid. But GM stopped building it in 2019.

There are several reasons why these range-extending technologies appear to be gaining ground. Over the last several years, the auto industry has announced close to $1 trillion in investments aimed at flooding the market with all-electric vehicles like the Ram 1500 REV and the Chevrolet Equinox EV. Those plans were buoyed by the huge burst in EV sales – which jumped from barely 1% of retail sales in 2019 to 8% by early 2023.

But demand unexpectedly leveled off later in the year and EV sales are expected to grow no more than about 10% for all of 2024. At the same time, both conventional and plug-in hybrid sales have started taking off.

That shift hasn’t been lost on the Biden administration which, three months ago, announced revised emissions standards calling for slower growth of all-electric models through the rest of this decade. Perhaps more significantly, the EPA revised longer-term goals, allowing fewer EV sales as long as manufacturers roll out more plug-based vehicles – as much as 15% of their total volume by 2032.

Alternatives

There actually are several alternatives automakers are looking at: plug-in hybrids and range-extenders. While the two systems are often referred to, interchangeably, as PHEVs, there are significant differences:

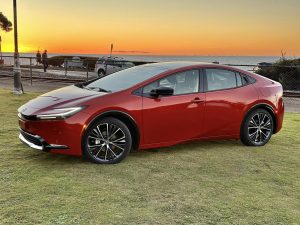

Conventional plug-in hybrids pair an electric drive system with an internal combustion engine. With the Toyota Prius Prime the vehicle’s wheels can draw power from either half of the drivetrain – or from both. The latest PHEVs can deliver as much as 50 or more miles in all-electric mode, enough to handle the typical day’s commute or errands for most motorists, according to Department of Transportation data. For longer trips, the internal combustion engine takes over but still gets better fuel-economy than the typical gas model.

Range-extenders, also known as extended-range electric vehicles, or serial hybrids, are somewhat similar, pairing both electric motors and an internal combustion engine on the same platform. But the wheels are only electrically driven. The gas engine serves solely as a generator, it’s only purpose is to recharge the vehicle’s battery pack when it starts to run down.

It’s been nearly 14 years since the first mass-market plug-based model, the Chevrolet Volt, came to market. It was intended to work as a range-extender – but GM cheated a bit. The sedan’s battery pack and motors didn’t deliver quite enough power so the drivetrain occasionally would link up the four-cylinder engine to give a little extra boost to the wheels under hard acceleration.

More Hybrid News

- Genesis Shifts Gears, Will Add Range-Extenders to Line-Up

- Jeep Will Offer 6 Powertrain Options – 5 of Them Electrified

- First Drive: Mazda CX-70 PHEV

What’s coming

“The Chevrolet Volt was right. It was just a little early,” said analyst Abuelsamid.

While he thinks that all-electric models eventually will come to dominate the market – as battery technology improves, prices drop and charging stations become more ubiquitous – Abuelsamid thinks PHEVs and EREVs will “make sense for a lot of people, especially for larger vehicles,” such as big SUVs and pickups and commercial trucks that carry large payloads or tow heavy trailers.

Whatever the reason, whether the slowdown of EV sales growth, the Biden administration’s revised emissions rules or other factors, expect to see far more plug-based hybrid models come to market.

Jeep, which already produces the two best-selling PHEVs in America – the Wrangler and Grand Cherokee 4xe models – plans to significantly expand that technology’s availability. It also will add the same EREV system used by sibling brand Ram in the 1500 Ramcharger pickup. The first application will be in the Wagoneer and Grand Wagoneer SUVs a year from now.

Genesis also is planning to add range-extended models, according to a report in the Korean Car Blog – though it’s unclear which of the two systems will be used. Mazda, meanwhile, is launching its second PHEV, the CX-70, and told Headlight.News demand on the original CX-90 plug-in is running 40% of total sales. More PHEVs are expected to follow.

“Not the endgame”

Among the other manufacturers that are expected to add PHEVs and E-REVs, GM CEO Barra will only say the first will appear in 2027.

But Barra is positioning these as a temporary solution. “It’s not the endgame,” she cautioned during an appearance at the Bernstein Annual Strategic Decisions Conference last week, “because it’s not zero-emission.” Long-term, she has stressed that GM remains on “a path to an all-electric future.” It will just take a bit longer to get there.

There are downsides to plug-based hybrids, whichever version. Among other things, “You have two propulsion systems on that vehicle,” Barra added. That increases the initial price tag, as well as maintenance costs, and raises the risk of reliability problems. EV proponents like Barra believe that, as the industry overcomes today’s concerns, all-electric models will win out – at least for most applications.

EVs are dead!

Uh, no. Not close. Gotta stop watching politicized “news” and start checking your facts.

As I noted in a separate reply to you: “The EV “craze” is far from “over.” How many segments of the U.S. market have experienced a 10% annual growth rate? That’s rare. But that’s also what EVs are on track for in 2024. Actually, preliminary numbers suggest that could be low. Even then, we’re likely to see them account for somewhere between 1.2 million and 1.3 million vehicles sold this year. That’s far from insignificant. Hybridized models, meanwhile, are now running slightly ahead and could reach or top 1.5 million. So, in total, at just short of 3 million, electrified vehicles will account for nearly 1 in 5 new vehicles purchased by U.S. motorists in 2024. And that doesn’t include so-called “mild” hybrids.”

BTW, every study I have seen shows that the number of Americans giving serious consideration to buying an EV is over 50%. That does NOT mean 50% are ready to buy them. It does mean interest is growing and could continue winning over more buyers as manufacturers: 1) add more products in more segments; 2) increase range; 3) address costs; and 4) as more public charging stations go into place. All four of those items are in process.

Paul A. Eisenstein