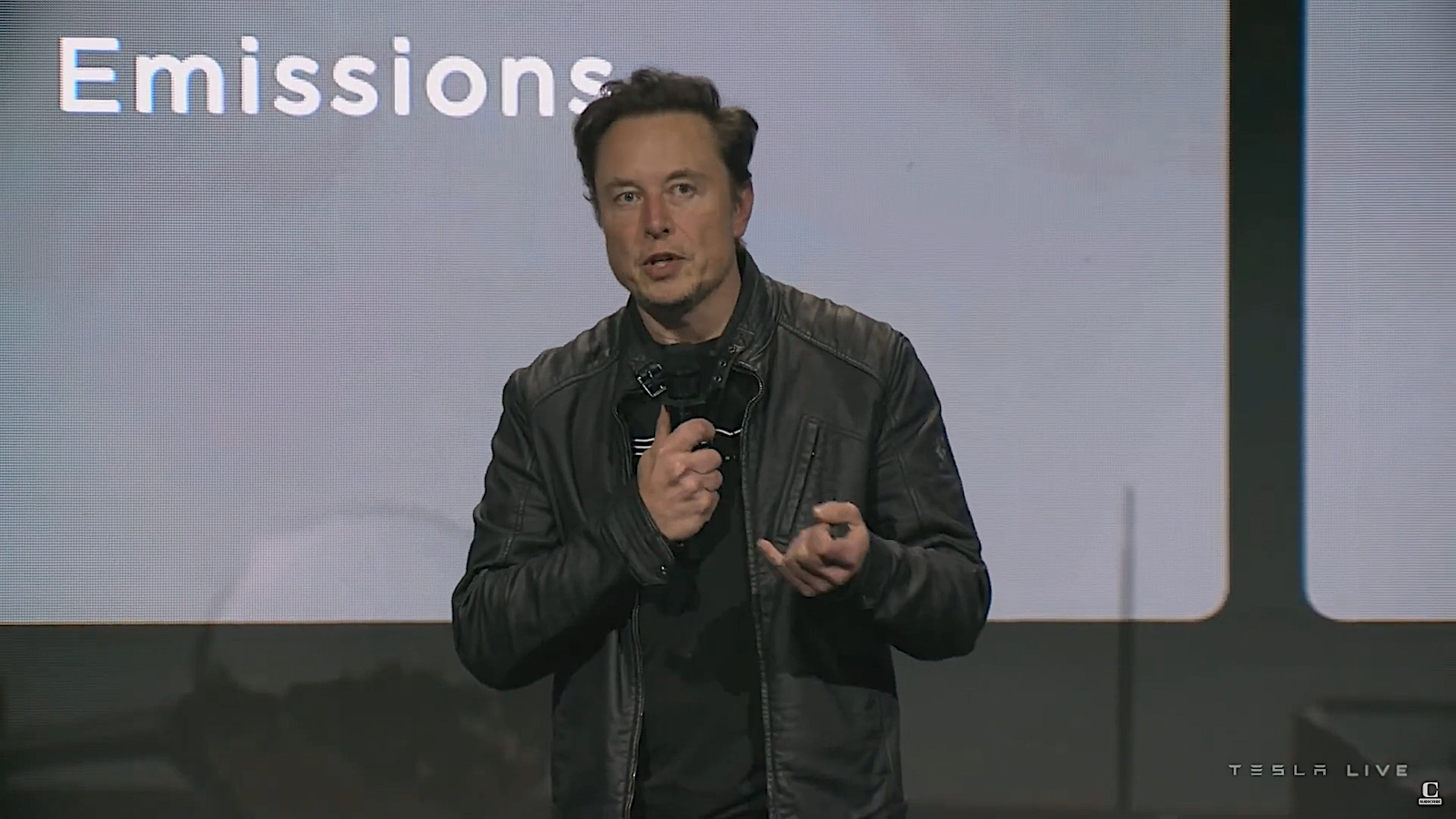

Tesla is wrapping up 2023 with another record under its belt. While sales hit an all-time high they still fell short of CEO Elon Musk’s ambitious forecast. And the Texas-based automaker has a growing list of problems on its plate, including mounting pressure for another recall following the one it announced two weeks ago.

Tesla is going to set a new record for deliveries, but fell short of CEO Elon Musk’s goal of 2 million vehicles for 2023.

Based on preliminary data, Tesla was expected to have delivered about 473,000 vehicles during the fourth quarter of this year, according to a consensus of 14 analysts polled by LSEG. That would bring the total for the year to 1.82 million vehicles for all of 2023. But the quarterly and annual numbers would fall short of the 2 million target Musk laid out inside Tesla at the beginning of this year. Tesla also set a record in the third quarter, while falling short of earlier predictions.

Going into 2024, Tesla remains the undisputed king of the EV market, outselling all competitors combined in the U.S. market. But its lead has come at a growing cost, Musk ordering a series of price cuts that have sharply reduced the automaker’s margins and earnings. And many analysts anticipate further discounting as Tesla — like competitors such as General Motors, Ford, Volkswagen and Hyundai — struggle to keep momentum in the EV market growing. Demand flattened out during the second half of the year, according to J.D. Power.

Mounting problems

At 1.82 million, Tesla’s global sales would be up 37% for all of this year. But Musk previously laid out an annual growth target of 50%, with 2023 expected to reach the 2 million mark if there was no “freaking force majeure,” or issues beyond the company’s control. Unfortunately, for Tesla, there have been, including a general slowdown in EV sales growth.

Musk previously laid out an annual growth target of 50%, with 2023 expected to reach the 2 million mark if there was no issues beyond the company’s control.

Several factors have contributed to that, including rising interest rates and the fact that EV prices are well and above the cost of comparable gas-powered models. Tesla has repeatedly promised to introduce more affordable models, but the $30,000 version of the Model 3 has yet to appear. And it appears likely the new, lower-cost Model 2 is still at least a year or two away.

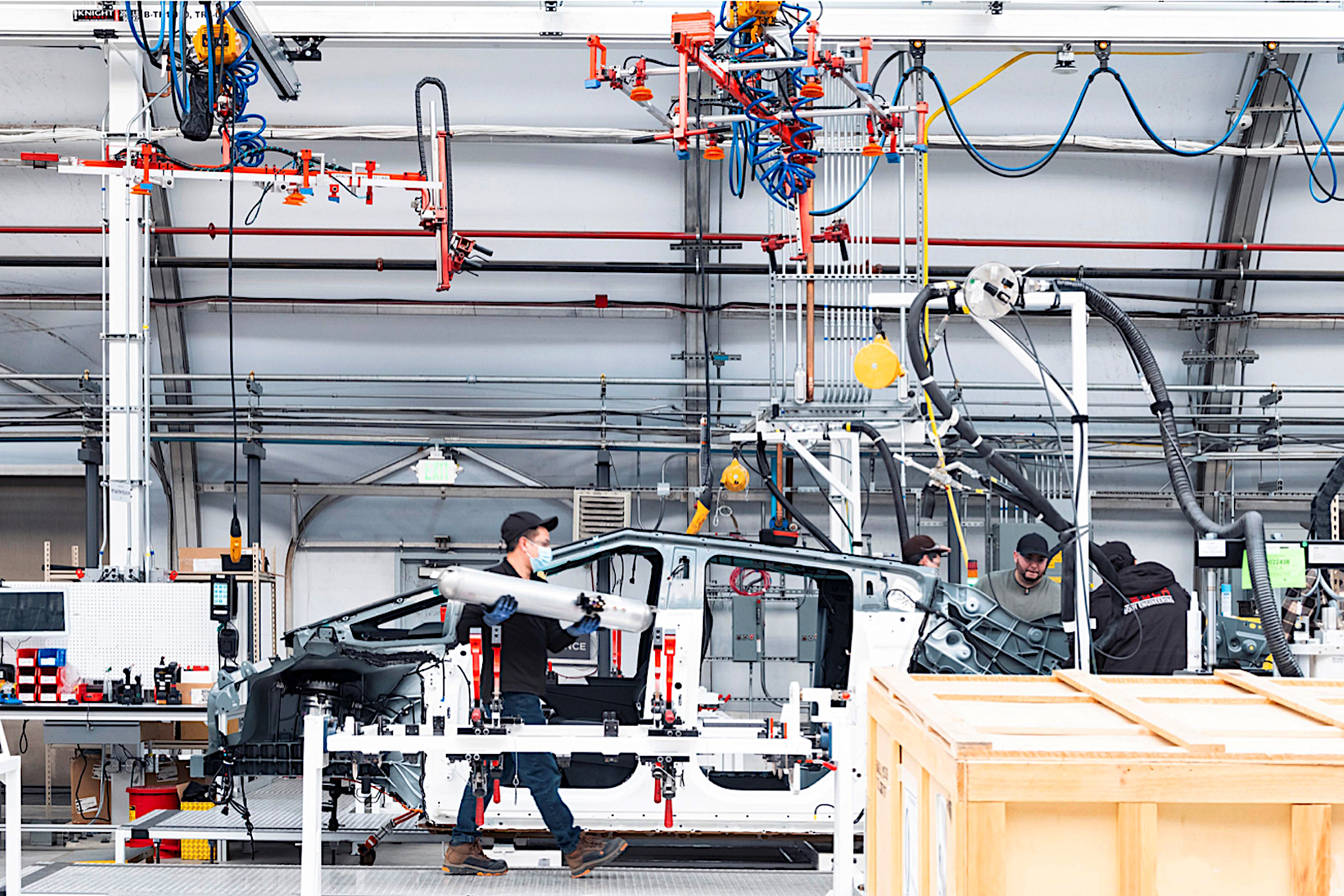

Meanwhile, even though Tesla finally delivered its first Cybertruck in November — fully two years late — it is expected to generate marginal volumes, at least in the coming year as Tesla works to break through bottlenecks at its Austin, Texas factory.

Customers catch the blame for safety problems

The New Year will begin as Tesla sets out to deliver a fix covering the 2 million EVs it recalled on Dec. 13. Virtually all of the products it has so far sold in the U.S. need to undergo repairs covering problems with the Tesla Autopilot system.

The service action was triggered by a series of crashes blamed on the semi-autonomous technology, including of fatal incidents. Since the fix centers around faulty software, Tesla plans to make repairs using its vehicles’ smartphone-style over-the-air update capabilities, limiting the inconvenience to customers.

But things could be far more problematic if it winds up facing yet another major recall, this time to deal with potentially serious suspension defects, Reuters reports.

“We write with extreme concern following recent reporting about Tesla’s knowledge of safety flaws in its vehicles and concealment of the causes of these flaws from the National Highway Traffic Safety Administration,” Senators Richard Blumenthal, of Connecticut, and Edward J. Markey, of Massachusetts — both active vehicle safety advocates — wrote Musk.

Tesla vehicles have had a high incidence of failures involving those components which, in some cases, have led to wheels falling off at highway speeds. In one case, Tesla has ordered a recall to repair a suspension piece called the aft link in China. But it has refused to take similar steps in the U.S., instead it has typically blamed owners for abusing their vehicles, causing such failures.

The Swedish affair

The suspension problem could lead to regulatory issues in every market in which Teslas are sold. But the automaker faces other problems abroad.

The notoriously anti-union Tesla is immersed in a fight with labor groups in Sweden demanding collective bargaining rights. Four technicians walked off the job Oct. 27, decrying what one called the “typical U.S. model,” Tesla demanding six-day weeks and plenty of overtime. The battle has generated significant pushback from other unions throughout Scandinavia. Dockworkers have refused to unload Teslas arriving by sea. Postal unions aren’t delivering the company’s mail.

UAW President Shawn Fain is directly overseeing the latest drive to organize plants in the southeast.

It’s not only Swedish workers pushing back. As part of the largest organizing drive in its history, Shawn Fain, the president of the United Auto Workers union, has specifically targeted Tesla and a number of observers believe the UAW has a chance to organize the Fremont, California assembly plant that has faced frequent labor turmoil.

More Tesla and EV news

- Where’s my affordable EV?

- Tesla recalls 2 million vehicles for Autopilot defect

- Tesla delivers its first Cybertruck

New product will be critical

With dozens of competing EVs coming to market during the last 12 months, and even more set to follow in 2024, analysts like Sam Fiorani, of AutoForecast Solutions, says there’s little chance for Tesla to maintain its once overwhelming market share. But it has proved harder than expected for companies like GM, VW and Toyota to gain ground than they once forecast.

How much Tesla will lose could depend upon its own product plans. Cybertruck is generally expected to have less of a positive impact than Musk once predicted, at least for now. One test will come with the launch of the updated Model 3 sedan — codenamed Highland — next year. The automaker then plans to push into more mainstream product segments.

Cybertruck is generally expected to have less of a positive impact than Musk once predicted, at least for now.

An under-$30,000 offering, likely to be called the Model 2, is in development, and Musk said he is personally reviewing production plans “every week.” Significantly, he promised the vehicle will bring a “revolution in manufacturing” capable of rebuilding margins even at such a low price.

Missing the target

The bigger problem is that overall slowdown in EV sales.

While Tesla will all but certainly miss the 2 million sales mark for 2023, it should break through that barrier in 2024 — but not by nearly what Musk had been forecasting, an annual 50% growth rate. A poll of analysts tracking the company by Visible Alpha comes in at 2.2 million deliveries next year. But Jairam Nathan, of Daiwa Capital Markets, has trimmed his forecast from 2.14 million to just 2.04 million, noted Reuters.

“Tesla candidly admitted the company is now in an intermediate low-growth period,” Deutsche Bank analyst Emmanuel Rosner wrote in a note, citing a meeting with Investor Relations Chief Martin Viecha.

Investors on edge

If all this wasn’t enough to worry investors, Tesla also has to deal with exogenous issues related to its CEO. Musk has generated a firestorm of controversy since his takeover of Twitter — now renamed X — 14 months ago. His swing to the right, including tweets perceived by many as anti-Semitic, have cost the social media site billions in lost ad revenue, as well as a string of user defections.

It’s also generated pushback from current owners and potential Tesla buyers, according to several analysts who spoke to Headlight.News, though it’s as yet unclear if this has been a factor in the fourth-quarter sales shortfall.

Tesla stock has long been volatile, but shares have ridden an even more aggressive rollercoaster than normal over the last year or so. And, with so many uncertainties, that’s likely to continue to be the case for the foreseeable future.

0 Comments