Just days after firing the head of Tesla’s Supercharger operations – and dismissing her entire 500-person staff – CEO Elon Musk appeared to reverse course, announcing on his social media site X that the automaker still will invest “well over” $500 million on “new sites and expansions” of the public charging system. The apparent turnaround comes as Tesla comes under increasing pressure from Tesla investors, analysts, owners and other automakers who have done deals to gain access to the Supercharger network for their own EV customers.

This past month has seen an unusual degree of turmoil at Tesla, even considering the normal level of turbulence at the Texas-based EV manufacturer. Facing heavier than expected losses from the first quarter, and uncertainty about the months ahead, CEO Elon Musk has announced a “hard core” cost-reduction effort that has led to a series of cuts, including the ouster of the company’s Supercharger chief, Rebecca Tinucci, and her entire 500-person staff.

According to various reports, work on a number of new Supercharger sites – including a dozen in Texas — was halted, the Wall Street Journal reporting that negotiations for new locations in New York State also were put on hold.

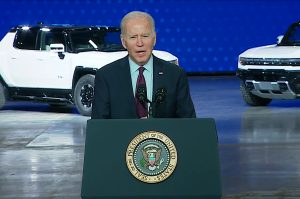

Amidst the seeming chaos, that has generated a particularly harsh backlash. The Supercharger network has been hailed as not only the largest and most reliable of the public charging systems and is often credited with helping position Tesla as the global EV leader. That’s one reason the Biden administration coughed up a $17 million grant to help it expand – and why effectively every other EV manufacturer has done deals this past year with Tesla to adopt the company’s NACS charger plug and gain access to the system for their own EV buyers.

Reversing course??

Now, in form with Musk’s mercurial nature, the CEO may be reversing course. In a new tweet on X, the former Twitter, Musk appeared to indicate that what was expected to be a rapid expansion of the Supercharger network will move forward.

The South African-born executive said Tesla will invest “well over” $500 million on the system, adding “That’s just on new sites and expansions, not counting operations costs, which are much higher.”

That said, Musk was vague on details. He’d already indicated that Tesla “still plans to grow the Supercharger network, just at a slower pace for new locations,” after Tinucci and her team were let go. So, what’s unclear is whether the spending plan Musk now says is underway will happen at the same pace as previously planned.

Unanswered questions

The other unanswered question is precisely who will oversee all this work if Musk doesn’t reverse course and retain at least some of Tinucci’s Supercharger team. It wouldn’t come as a complete surprise if he did so, said one former executive who worked with Musk. Speaking on background, he noted that the executive had, on more than one occasion, dismissed employees, only to tell them to come back to work a day or three later.

At one point in 2019, Musk announced that all Tesla stores would close, the company switching entirely to online sales, Ten days later, noted the Bloomberg news service, Musk said never mind.

More Tesla News

- Angered by Tesla Supercharger Cuts, Rivals Look to Other Public Charging Options

- Tesla Gets a Big Boost from China

- Could Tesla Go Bust?

Why did Musk blink?

If Musk has, once again, reversed course, the question is why?

There has been plenty of pushback from a variety of quarters. Tesla stock took an initial hit and there’s been increasing resistance from investors ahead of a vote called to consider reinstating Musk’s $56 billion pay deal.

There’s the possibility the feds could seek reimbursement for the $17 million grant.

And several of the automakers who struck deals with Tesla to gain access to the Supercharger network have signaled they may seek alternatives. At least one major manufacturer told Headlight.News on background it now is likely to join the new Ionna charging network established by several EV makers including General Motors, Mercedes-Benz, Hyundai and Kia.

Perhaps the biggest concern is that with the carmaker’s sales already showing weakness during the first quarter, some worry this could send a bad signal to potential buyers, further eroding Tesla’s leadership.

0 Comments