President Joe Biden raised tariffs on an assortment of Chinese-made goods, including the battery-electric vehicles manufacturers like BYD, Geely and Great Wall have been hoping to start selling in the U.S. The threat of these inexpensive EVs – some starting at barely $10,000 – has sent shivers through the American auto industry, one trade group warning their arrival poses an “extinction-level event.” Headlight.News explains why.

Just south of the American border with Mexico this week, one of the correspondents for Headlight.News is getting a firsthand look at the BYD Shark. The new pickup is the latest in a fast-growing line-up of products from the Chinese automaker and one of several that BYD eventually hopes to start selling in the United States.

The company – whose name is short for “Build Your Dreams” – is just one of several Chinese automakers now targeting global markets, with a heavy emphasis on EVs. Collectively, they now account for 87% of the South American EV market and are rapidly cutting into Tesla’s leadership at home. For the moment, Chinese brands are notably absent from the U.S. market, though products imported from China are now being offered by familiar marques like Buick, Lincoln, Polestar and Volvo.

And that is causing a seismic uproar within the American auto industry, the trade group, The Alliance for American Manufacturing warning that government subsidized Chinese battery-electric vehicles “could end up being an extinction-level event for the U.S. auto sector.”

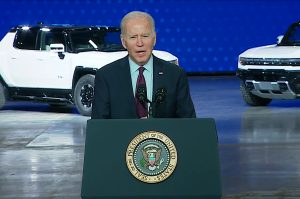

Biden steps in with new tariffs

On Tuesday, the White House announced new tariffs for a variety of Chinese-made goods. They will double, to 50%, on solar cells and semiconductors, while jumping to 25% on aluminum and steel products. Even Chinese-made hospital syringes and needles will be impacted, tariffs going from 0 to 50% this year.

But some of the biggest increases will target Chinese automobiles. Already at 25%, tariffs on Chinese EVs will quadruple, to 100% starting in 2025. Meanwhile, lithium-ion batteries and battery parts will see tariffs rise to 25%.

Chinese officials quickly responded, Ministry of Foreign Affairs spokesman Wang Wenbin denouncing the new tariffs as “self-defeating.” He also argued that the move by the Biden administration “will harm the world’s green economic transition and climate action.”

But the response was far more positive in the U.S. “Counter(ing) China’s unfair trade practices is absolutely the right thing to do for America’s future,” the Alliance for American Manufacturing said in a statement.

Build Your Dreams

Chinese automakers have long dreamed of staking a presence in the U.S. market. Brands such as BYD and Geely were frequent participants in industry events, notably displaying some of their vehicles at the North American International Auto Show a decade ago. BYD even set up an American headquarters in Los Angeles.

But those early models were crude, with obvious manufacturing issues, weak performance and a lack of the features most American motorists had come to expect. No longer. Their latest entries, such as the Shark, are far more refined and capable. And they are substantially less expensive than comparable products from the U.S., Europe, Japan and South Korea.

Another BYD model, the all-electric Seagull, is a good example. First introduced in China last year, it carries a base price of just $9,700. That’s for a version with a meager 37.8 kilowatt-hour lithium-iron phosphate battery, barely half of what most other manufacturers opt for. As a result, range is severely limited. But various analysts estimate BYD could opt for a longer-range pack more in tune with American requirements and still keep prices well under $20,000.

Products like the Shark and Seagull are rapidly transforming BYD from a nice to a mainstream player. It shocked the EV community when it outsold Tesla for the first time during the fourth quarter of 2023.

More EV News

- Biden Announces Sweeping Tariffs on Chinese Goods

- Detroit Automakers Watch as Chinese Collapse – US Could Be Next

- Pres. Biden Orders Probe of Nation Security Threats from Chinese Smart-Cars

Taking on the world

Geely – its Emgrand model shown here – is another fast-growing Chinese automaker with a range of global subsidiaries including Volvo and Polestar.

Until a few years ago, Chinese domestic automakers struggled just to survive. Foreign manufacturers such as Volkswagen and General Motors dominated the industry there as it grew into the world’s largest automotive market. But things have changed – in part due to the Beijing government’s intervention.

There were hundreds of local brands vying for buyers, noted Michael Dunne, a well-respected analyst specializing in the Asian auto industry, but many have been forced to close or merge. More significantly, government subsidies have become “the secret weapon” making it easier for domestic brands to undercut competitors. That’s especially true in the EV market where they get better access – at lower costs – to batteries and raw materials, according to the latest issue of the Dunne Insights newsletter.

Initially, this gave Chinese automakers a chance to compete in the home market. And, as their fortunes have grown, they’ve begun eyeing the rest of the world. According to Dunne, brands like BYD and Geely now have put in place enough production capacity to supply around two-thirds of the vehicles sold worldwide.

Investors embrace the Chinese

Officials from Zeeker celebrate their U.S. stock listing by ringing the bell at the New York Stock Exchange.

The Beijing government isn’t alone in betting on Chinese automakers. Warren Buffett’s Berkshire Hathaway has been a long-time investor in BYD.

Wall Street responded positively when Volvo spinoff Polestar staged its initial product offering a couple years ago.

The latest to go public is another spin-off, EV maker Zeekr Intelligent Technology Holding, which scored some impressive gains following its own IPO earlier this month. Shares jumped 35% last Friday, another double-digit increase coming on Monday.

The Biden tariff announcement has put a pause on those gains, The stock – traded under the ticker ZK – was off roughly 6%, about $1.70 a share, at midday Tuesday. But that’s a relatively modest dip compared to some of the ups-and-downs rival Tesla has experienced in recent months, the Texas-based manufacturer at one point last month down 40% since the beginning of the year.

Will tariffs head off the Chinese invasion?

Even with their extremely low prices, a 100% increase in tariffs will clearly make it much more difficult for Chinese brands to crack into the American market. And Biden’s move is likely to spell trouble for other manufacturers who had hoped to import EVs, as well as Chinese-made batteries

Even with their extremely low prices, a 100% increase in tariffs will clearly make it much more difficult for Chinese brands to crack into the American market. And Biden’s move is likely to spell trouble for other manufacturers who had hoped to import EVs, as well as Chinese-made batteries

Polestar and Volvo are likely to be hit hard. The Polestar 2, for example, is built in Luqiao. Volvo C40 and XC40 EVs are both imported from China and Volvo was planning to start importing the new EX30 and EX90 from China, as well. The smaller of those two will eventually be double-sourced and the U.S. is expected to start importing the EX30 from Europe. Meanwhile, Polestar will build a version of the new Polestar 3 at a plant it shares with Volvo in Charleston, South Carolina.

Going forward, BYD is planning to set up a factory in Mexico, according to a report by the Nikkei. The automaker already committed to a $620 million manufacturing complex in Brazil which, ironically, is located on the site of a factory Ford abandoned in 2021. Other Chinese automakers reportedly have begun looking at Mexico as it could help them sidestep the new tariffs by taking advantage of the North American Free Trade Agreement modified under the Trump administration.

If anything, the tariffs could pay off for the U.S. when it comes to batteries and their raw materials and components. Production has already begun moving to the States due to the strictures of the Inflation Reduction Act passed by Congress in 2022. It sets strict mandates for battery sourcing in order for vehicles to qualify for up to $7,500 in federal tax credits. As Headlight.News previously reported, there’s now commitment to produce about 1 tWh of lithium batteries domestically by 2030, up from about 50 gWh when Biden took office.

“If, not when”

Volvo will likely sidestep the new tariffs, at some point importing the EX30 from a plant in Europe.

While the new Biden tariffs – especially those covering EVs and batteries – are winning immediate praise domestically, not everyone is confident they’ll work.

“BYD’s entry into the U.S. market isn’t an if. It’s a when,” Sam Fiorani, the chief analyst at AutoForecast Solutions, told the Detroit News.

Even if Chinese manufacturers are locked out – or severely limited by higher prices – they’re expected to continue gaining ground in other parts of the world.

“They will pretty much demolish most other car companies in the world,” Tesla CEO Elon Musk said earlier this year. The fact that BYD toppled Tesla from its global sales throne last year should add gravitas to Musk’s warning.

0 Comments